|

|

|||||||

| Off Topic This section may contain threads that are NSFW. This section is given a bit of leeway on some of the rules and so you may see some mild language and even some risqué images. Please no threads about race, religion, politics, or sexual orientation. Please no self promotion, sign up, or fundraising threads. |

|

|

|

Thread Tools | Display Modes |

|

|

#3251 | |

|

Member

|

Quote:

Yes, the ATR was what I used and I look at the 4hr / daily to see where the closest MA is to a key level. So the ATR and the 4hr 5ma were my 2 stop outs if it broke above 5700 Add to that everyone's risk tolerance is different so if you can't expand out you can still do the 5-6pts

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

|

#3252 |

|

Member

|

Beautiful

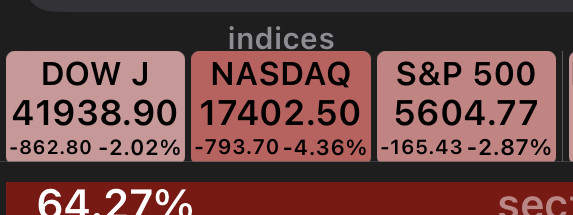

Technicals are playing a big role and also crypto moving lower is having an effect on all the crypto names If the idea is for interest rates to move lower then most of banking names will move lower

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

#3253 | |

|

Member

|

Didn't expect this - all out of other half here

Looked like they would expire worthless but shot up to $2k per contract Great trade  Quote:

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

|

#3254 |

|

Member

|

You must have had a better fill than I did. My fill was $20.00 per, so that was break even for me.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#3255 | |

|

Member

|

Quote:

Great trade because I wrote these off

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

|

#3256 | |

|

Member

|

Quote:

But yes, this have been on the backfoot since entry.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

|

#3257 |

|

Member

|

No trades today, market could move but CPI/PPI weds n thurs will give better moves

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

#3258 | |

|

Member

|

Quote:

If you happened to catch the analysts and “experts” on MSNBC telling ppl to jump in at ATH’s, it’s easy to see why retail investors lose - they’re used as liquidity to get out of positions at highs I was just happy to get out at about breakeven as you know how much that position was down majority of the time I had it. But this sell off/correction should have happened way before March

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

|

#3259 |

|

Member

|

Reminder, overall theme still is for interest rates to move lower and larger capital to get sucked into the US market

That's what I'm waiting on

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

#3260 |

|

Member

|

Damn. Didn’t expect that big of a move today. Missed it

Once interest rates come down and gov can refinance at a lower rate the markets gonna fly Powell was supposed to cut rates last week but didn’t lol At this point it’s just a waiting game

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

#3261 | |

|

Member

|

Lol

That was fast Quote:

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

|

#3262 |

|

Member

|

CPI came in slightly under across the boards. Probably look to close my 3/31 Put position obviously selling yesterday at 552 would have been more ideal.

Probably only looking to take trades at Key Levels today with confirmations. 5700 (5670/75), 5650, (5633), 5600 SPY 565.5, 552.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#3263 |

|

Member

|

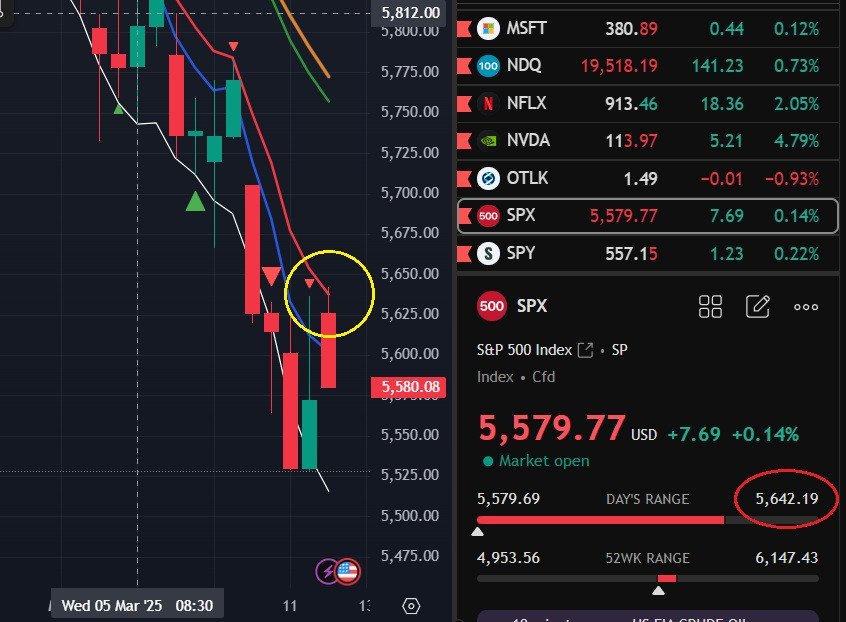

Took this 8ema reject - all done for the day

8ema reject off the push up while flow was selling Will watch what PMI does tomorrow  Hopefully some trades were taken and money made. But "money made" isn't as important as figuring out the correlation/causation and market technicals That said, there's no better time to learn a high income skill that could potentially be life changing Back at it tomorrow

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

#3264 |

|

Member

|

Mentioned this back in the stock market thread about 3 years ago

Don't really check my shares too much as I mainly focus on options for day trading I think this 4 year term is going to be FNMA's release from conservatorship When it's released FNMA should fly Should have bought more back when it was a $1 Something to watch - it was over $7/sh the other day

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

#3265 | |

|

Member

|

NLR - Going to watch this ETF now

Quote:

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

|

#3266 |

|

Member

|

Two trades today, one bad rookie trade, one better managed (bad entry trade).

First trade was at 10:03, was watching for break below 5596 ATR with 5600 above, didn't take first trade when it broke below because the 1m candle broke and closed but next candle broke above. The 10:03 entry was a FOMO/Rookie mistake when I saw market drop quickly below, my thought was that this was going to be a big momentum move down, market immediately bounced right back up, 10 point 1m candle whipsaw. Was holding until above 5603, early intraday S/R, it broke above so I cut and looked for another entry. Waited until for broke below again, which it did, more patient, but didn't wait for full retest, had a I waited for full retest of level, break above would have invalidated it. I did however continue using 5603 as S/R for area to exit if break above, it held twice, then market finally moved down (Flow was selling, volume showed sellers in control with multiple red candles, trend was red). Only took two contracts on second entry. Sold first contract at touch of previous close. Held second contract due to volume, flow, trend, with the expectation of breaking and testing 5550. Sold contract when market looked like it was moving up at 10:54, should have held until break above 5589 (market bounced twice earlier), then I would have been in position for 5550. Lost on first trade, made profit on second, first trade was bigger position so total today was a loss. Still learning. Only thing that frustrates me is the bad entry (this one I knew better), and not being able to do this every day. Could care less about the money now, it's only a couple hundred when I lose. Back at it next Wednesday, until then, OnDemand paper trades to practice entry and management.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#3267 |

|

Member

|

PPI in 4

No idea what it’s going to do but should be fun either way

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

#3268 | |

|

Member

|

Quote:

Good trades and thought process, just some minor tweaking and patience and the entries/exits will be on point

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

|

#3269 |

|

Member

|

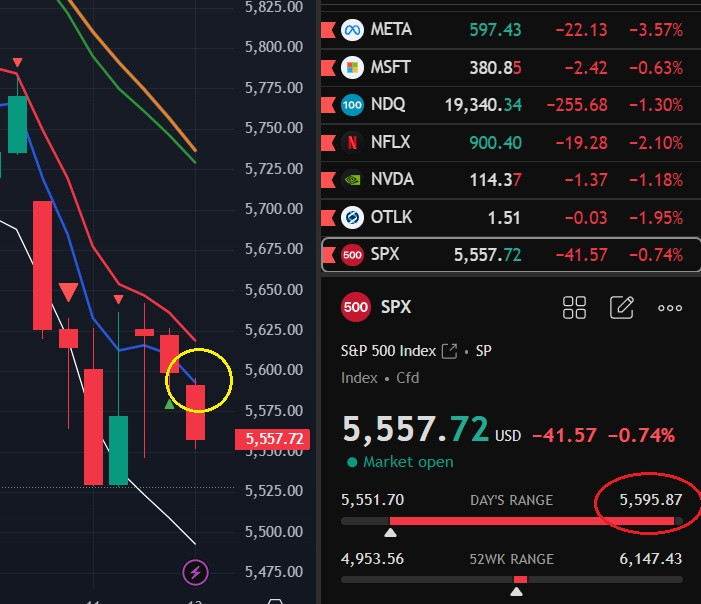

Market didn't react to PPI and jobs, futures flat

So might get a relief bounce today SPX: 5600 key level / 5550 (5497) / 5650 (5673) SPY: reject 565.2 area If the market chops I'll call it a day early and check back power hour

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

#3270 | |

|

Member

|

Quote:

Flow is starting to buy so it might bounce and retrace like yesterday - not taking a call position. All you need is one good trade Waiting for 5600 again to see if it can break and hold or another reject Watching flow - flow is sideway right now Added some 2dte calls for SPY @ 5550. Will cut if it breaks below 5550 with strength

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

|

#3271 |

|

Member

|

Should have got a relief bounce today but looks like hedge funds are trying to create entry positions

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

#3272 |

|

Member

|

This sell off has nothing to do with tariffs, absolutely nothing

If you've read any books on how the market works and understand how the market works you would have been positioned for this pullback Reality is retail traders are naively optimistic and lured into the market by occasional wins. But systematically they are ill prepared to navigate the market and this is easy pickings for smart money & MM's just running around like a vacuum cleaner sucking up free cash System is built on the banking industry and wealth transfer from working class to top 1%ers. You either understand how it works and get on board or you get raked, stay on the hamster wheel, and keep powering the wealth transfer The stock market thread is a great example of the above

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

#3273 | |

|

Member

Join Date: Jul 2011

Posts: 1,760

|

Quote:

Also, what indications led to a potential relief bounce for this morning's premarket plan or was it just the lack of movement from data and futures being flat, especially after so many days of the market opening significantly lower? I see that we are outside the BB's on the weekly as well, so I wasn't sure if that factored in to a potential relief bounce or if that could indicate a potential relief rally this week or next week. Thank you! Last edited by lane121; 03-13-2025 at 02:28 PM. |

|

|

|

|

|

|

#3274 | |||

|

Member

|

Quote:

Tweets from Pulte after he got FHFA nomination yesterday evening Good start Quote:

Quote:

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|||

|

|

|

|

|

#3275 | |

|

Member

|

Quote:

As far as understanding how the market works, just study MA's, how the market makers work (rebalancing / buying selling), and what moves the markets (options). Haven't seen or found a good book on it, just picked up bits and pieces along the way I'll see if I can find something on it this evening

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

| Bookmarks |

|

|