|

|

|||||||

| Off Topic This section may contain threads that are NSFW. This section is given a bit of leeway on some of the rules and so you may see some mild language and even some risqué images. Please no threads about race, religion, politics, or sexual orientation. Please no self promotion, sign up, or fundraising threads. |

|

|

|

Thread Tools | Display Modes |

|

|

#1551 | |

|

Member

|

Quote:

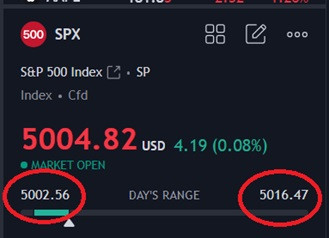

SPX: gaps @ 5002 & 5017✅- gap to gap ftw. Bang. Got in calls @ the 5002 gap and exited @ 5017 (close enough). took puts @ the 5017 gap. All done for the day. Gains for the day $7.8k  Hope everyone enjoys the rest of their day. I'm taking a long weekend, so if anyone trades OPEX, trade it smart. |

|

|

|

|

|

|

#1552 |

|

Member

|

That 5k bounce paid today if you caught it. ATR's on point too.

I didn't catch it, was busy this morning but that was a nice bounce after data.  Markets closed Monday, back at it Tuesday.

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

#1553 | |

|

Member

|

Quote:

Consumer sentiment. Just checked.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink Last edited by ajlaxmn; 02-16-2024 at 06:42 PM. |

|

|

|

|

|

|

#1554 |

|

Member

|

Option thread on the second page. Yikes.

Couple of fed speakers today and FOMC minutes. NVIDIA earnings post market so I'm sure that will have a an impact today into tomorrow. Key level 4950. Gap 4999.47. Watching ATR's.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#1555 | |||

|

Member

|

Quote:

Quote:

Quote:

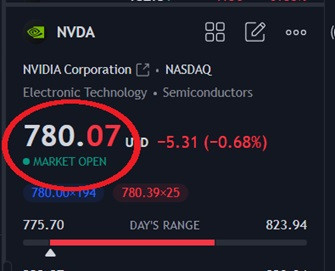

I still have my NVDA puts✅ Still holding my NVDA puts✅ NVDA is moving like TSLA did when it was a 900 - 2000 stock. Wild swings✅ Finally able to sell my NVDA puts. Sold all but one to hold through earnings. Gains from this trade $7,390 - High confidence trade that I gave time to play out and watched the daily resistance levels. I was down over 45% at one point when it pumped over $700. Nice gains from NVDA, now we'll see what earnings do. I'd like to see my one runner can get deep ITM. With NVDA trading @ 120 p/e it's due a nice pull back. Earnings might be the catalysts. If NVDA pumps off earnings I'll be looking for another short entry.

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|||

|

|

|

|

|

#1556 |

|

Member

|

Well, didn't get that pull back on NVDA, see if it can hold the gains overnight. Glad I exited 99% of my puts earlier.

Next short entry on watch.

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

#1557 |

|

Member

|

NVDA pumped off earnings. So no bias today.

SPX: watching for a 5000 bounce. Gaps @ 4999.5 & 4983. Both of those are on watch as well NVDA - is on watch. Will see what it does around 800 (not today but it's marked on my charts) Trade smart watch flow and don't force anything - be patient. Main watch 5000 on SPX

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

#1558 |

|

Member

|

NQ is hitting resistance which is why we're stalled here.

Being patient and waiting to see if it wants to break or reject before taking SPX as SPX is outside of ATR ranges. Only trades I've taken so far are futures.

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

#1559 | |

|

Member

|

Quote:

There we go. Took some SPX puts off that 2nd NQ reject. I think I'll call it a day here as the market is in a tight range. Exited off the bottom range they've been giving us. This is why you have to watch new intraday levels that form. Gains from today $3.9k ------------------------------------------ Patience is key in trading. Trading is also about probabilities. You want to wait for high probability trades and not just enter and exit for no reason. On days after a big move be patient and let the market settle down. SPX/SPY are both outside ATR ranges so I took trades based off NQ ATR's. For new and people learning, it's better to not trade than use NQ levels. Back at it tomorrow.

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

|

#1560 |

|

Member

|

All time highs, so watch whole psych numbers & ATR's

SPX: Broke 5100 premarket so reject there invalid, 5100 is likely support now. I'll be patient off the open and watch for a retest. Don't force anything and follow the trend. Also as a reminder don't trade in between levels. Wait for a solid trade setup. Market looks strong premarket so not looking for puts unless I see a signals of a reversal.

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

#1561 | |

|

Member

Join Date: Jul 2011

Posts: 1,760

|

Quote:

|

|

|

|

|

|

|

#1562 | |

|

Member

|

Quote:

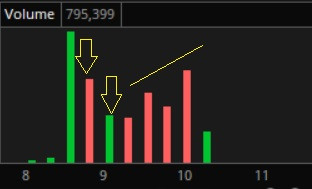

NVDA - Will see what it does around 800 (not today but it's marked on my charts)✅ - took puts @ break below and retest (my absolute favorite setup) of 800 for a 20 point drop. We actually dropped 25 points but it happened to quick and I didn't exit until 780 Gains from NVDA - $5k  Entered @ the break below & retest of 800 exactly as I planned  --------------------------------------------------------- SPX 5100 bounce was a no go based on volume. Should not have been looking for calls  Trading options is only as hard as you make it. If you set alerts and be patient, the trades will come to you. No levels hit, no trades. It's that simple. Patience is where people fail @ trading. Hope this was a good learning day. Hope everyone also sees why alerts are important.

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

|

#1563 | |

|

Member

|

Quote:

SPY just bought the whole flow, from -1.3B to zero net. Just broke above last close I'll watch what we do here.

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

|

#1564 | |

|

Member

|

Quote:

Broke above, second yellow arrow was the retest - hope you caught it - 11 point move

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

|

#1565 |

|

Member

Join Date: Jul 2011

Posts: 1,760

|

I didn't manage to catch that one, unfortunately. At some point it'll click, but I'm going to take time to review previous posts this weekend, look at some charts, and prep for the new week ahead. Back at it again Monday with new lessons to be learned.

|

|

|

|

|

|

#1566 | |

|

Member

|

Quote:

I just re-read your last post and I saw you said: I didn't catch that earlier. But a break below a support - look for puts (because support is now resistance) or be patient and see if we can reclaim + retest. A break above resistance - look for calls (because resistance is now support) or be patient and see if we break back below + retest.

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

|

#1567 | |

|

Member

|

Quote:

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

|

#1568 | |

|

Member

|

Quote:

Just make sure the stock you plan to do that with moves and has liquidity so you don't get stuck in a position and can't sell or you're forced to exercise on expiration day when they expire ITM. Just because they're ITM doesn't mean they will sell. MSFT/AAPL/TSLA/NVDA/META are the main ones I trade outside of SPX I'd still do at or ITM as well unless you want to practice some 6mo+ out leaps.

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

|

#1569 |

|

Member

|

The GDP revision data on Wednesday is the biggest data drop this week. So keep it on watch. Also watching consumer confidence & consumer sentiment

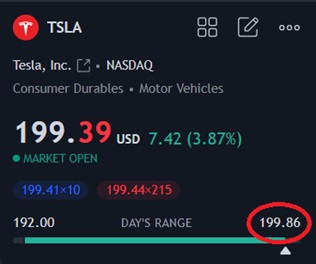

SPX: 5100 is the key level. Be patient and watch what we do there. Top 5130 Bottom 5070 (if we break below 5170 there's room to 5050) Watching: Check daily charts TSLA - looks weak right now - might watch for short entry if it holds below 190. Still looking for TSLA around 170 > 160 area for equity add. TSLA also has a gap around 207 - so a break above 200 should fill it Also watching NVDA 800 & AMD 180 - will wait for confirmation on these The above are positions I will be in and out the same day. Not holding or swinging with big data this week.

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

#1570 | |

|

Member

|

Quote:

watching NVDA 800✅- entered @ break below 800 (VWAP) > exited some below last close and the rest @ the reclaim of last close. Contracts moved from $1,750 > $2,450/$2,350 gain of $600/$700 per contract Only trade I've taken so far.  No trades on SPX. Missed the 5100 reject watching NVDA. Ask touched 5100 that would have been a good entry back to last close. Tight range on SPX though - not liking it until it breaks either way.  Probably call it a morning here and come back power hour. ------------------------------------------------------- TSLA short entry if it holds below 190, keeps rejecting 200✅- could have taken the 190 calls when TSLA held above 190 (192) and rode them to 200  AMD rejected 180✅ - missed it but got a 7 point drop off the reject  ------------------------------------------------------ Find your levels and have confidence in what you see. Pick one or two and focus on them - no reason to have more than 2 positions going at a time. Everything on watch worked out this morning ------------------------------------------------------ Just broke below last close on SPX - see what it does here but I won't be trading it. Already made enough off NVDA.

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

|

#1571 |

|

Member

Join Date: Jul 2011

Posts: 1,760

|

Bought puts at the touch of the 12:30 SPX candle after Spy closed below the ATR for the 12:15 candle. The 11:45 and 12:15 SPY candle indicated buyers were slowing and the 12:00 SPY candle indicated slightly stronger buyers present than both the 11:45 and 12:15 SPY candles. Additionally, we were in a downtrend. Gains for the day, 1.6k. However, I made the mistake of assuming too much risk and so I ended up scalping instead of letting the trade play out longer, even though there were no immediate signs of reversal or momentum loss.

|

|

|

|

|

|

#1572 | |

|

Member

|

Quote:

When it's in a tight range like today I don't usually trade SPX because not into scalping. I want the larger moves which is why I watched NVDA today. But awesome risk management and decision making

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

|

#1573 |

|

Member

|

Added some WMT equity today @ 59.50 and sold covered puts --WMT260116P60. This is a log term hold so selling puts 2 years out to collect the premium and WMT also pays a dividend

Nice sell off at close. Starter position for TSLA -TSLA240308P200 1/2 size Tomorrow is consumer confidence.

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

#1574 |

|

Member

|

Consumer confidence at 10. And if you noticed, volume is decreasing across the indices

SPX: 5100 key area / 5120 top / 5050 bottom + ATR's Watching: SPY - Bounce 503 area or look for an uptrend. TSLA - broke above 200, should fill the gap today. Started my light puts position yesterday 2 weeks out for that reason. NVDA - might watch NVDA again. 800 seems to be a struggle. Should get some good movement today, as always, be patient and wait for levels to hit.

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

#1575 |

|

Member

|

NVDA didn't give me my puts entry.

Took some NVDA calls. NVDA bounced the same area the last 3 trading days. All out @ VWAP before data for a 10 point move

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

| Bookmarks |

|

|