|

|

|||||||

| Off Topic This section may contain threads that are NSFW. This section is given a bit of leeway on some of the rules and so you may see some mild language and even some risqué images. Please no threads about race, religion, politics, or sexual orientation. Please no self promotion, sign up, or fundraising threads. |

|

|

|

Thread Tools | Display Modes |

|

|

#26 |

|

Member

|

A lot of levels today so be smart when trading. Gaps are levels too, so watch them as well.

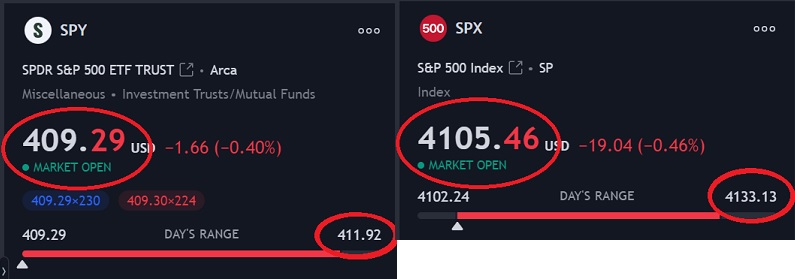

SPX: 4200 top / 4100 bottom (break below 4080 next support) / 4150 key level (4175 resistance) - Gaps @ 4089.4 / 4127.6 / 4218.7 Watching: SPY - Watching 411.4 for a potential bounce (starter position). After that 410.9 full position w/ confirmation. Main reject @ 415 Be patient and let the trades come to you. Patience is key, don't force anything. |

|

|

|

|

|

#27 | |

|

Member

|

Quote:

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

|

#28 | |

|

Member

|

Quote:

With screen time and doing levels daily stuff like this will start to click. For the amount of time you've been doing this, you're doing a great job at applying what you've been learning. But the fine tuning will come with time. Last edited by Blazed; 04-04-2023 at 09:32 AM. Reason: Fixed typos |

|

|

|

|

|

|

#29 |

|

Member

|

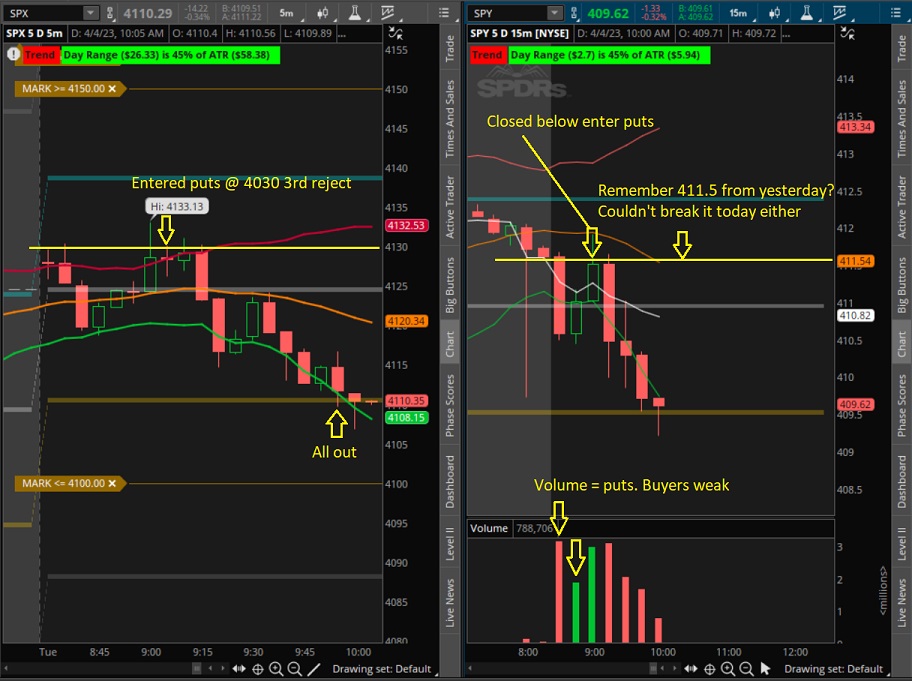

Took SPX 4125 Puts, based on initial volume and SPX breaking below previous close, SPY was below lower BB and VWAP, was down $500 at one point but held and sold for a $200 profit around $4015, sold too early, we were trending down and sellers were present.

Wondering if Call could be in play if we shoot back up, not assuming we go range to range, but I am going to watch calls. If SPY holds 408 i might consider calls. 408 was support yesterday, pre market yesterday, and over the weekend. However we are in a downward trend so I would be fighting the trend. Still I'll see how SPY reacts to 408.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink Last edited by ajlaxmn; 04-04-2023 at 10:20 AM. |

|

|

|

|

|

#30 | |

|

Member

|

Quote:

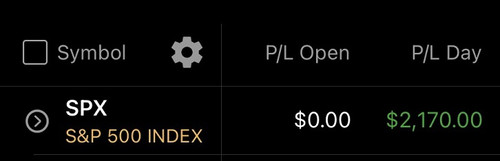

Only took one trade today and went light. Volume wasn't where I wanted it to be earlier. SPX: 4100 bottom✅ - exited my puts @ the touch of 4100 SPY: Watching 411.4 for a potential bounce✅ - support turned resistance - entered puts here. 411.5 on SPY is the next big level it needs to break above.✅   What I saw: If you remember 411.5 from yesterday, that was the next big level SPY needed to break through to continue higher. We broke above premarket but couldn't hold it after market opened. Off the 3rd reject I entered puts, volume confirmed down side and we clearly weren't going to break 411.5 with so many sellers stepping in. This is stuff you have to catch intraday (support turned resistance and vise versa) and this is also why I always say, no bias, take what the market gives. This is also why major levels should remain on your charts. Hope everyone enjoys the rest of their day.

|

|

|

|

|

|

|

#31 | |

|

Member

|

Quote:

Calls would be in play if we can get a volume flip or touch 4080. But looks like sellers are too strong at then moment. |

|

|

|

|

|

|

#32 |

|

Member

|

Haven’t been able to trade much with class, but took a 4/05 408 call at the 407.45 support level on SPY since I saw the volume slow from sellers and switch to buyers. It bounced perfectly and I cut for a super quick 20% profit.

This is why I am realizing plotting levels is so important. I do not have to do a lot of work, and if it hits one of my levels and the volume is good. I can feel comfortable taking an easy trade. Last edited by Braswell10; 04-04-2023 at 11:32 AM. |

|

|

|

|

|

#33 |

|

Member

|

I didn't like my entry as much as yours, you waited for the confirmation better I think, still I had a reason I took it, not sure VWAP and BB were that impactful, but the Volume and break below previous close on SPX were the main factors. Holding onto my position through an initial loss of 500 was key for me, however I exited too early even when volume and trend showed a their was room to go down. I can 100% say that initially being down 500 was a reason why I cut at $200 profit so I could walk away ahead in the trade. This to me was more a mental "get out of the trade" than it was an indicator showing it was time to get out.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#34 |

|

Member

Join Date: Oct 2013

Posts: 10,001

|

This is great. To all the turds that ran you off the other thread f them. It is not about investing it is about getting in and getting out with laser focus. I am still ramping up for my crack at this.

|

|

|

|

|

|

#35 | |||

|

Member

|

Quote:

Great trade too! Those 20% gains will add up quick especially when you more up to multiple contracts (if you haven't already) and can leave a runner or 2. Quote:

Quote:

|

|||

|

|

|

|

|

#36 |

|

Member

|

ADP numbers today were good for pump but we all know ADP is always wrong. But the thing is, NFP data comes out on Friday which is a Holiday - so let's see what the market does here.

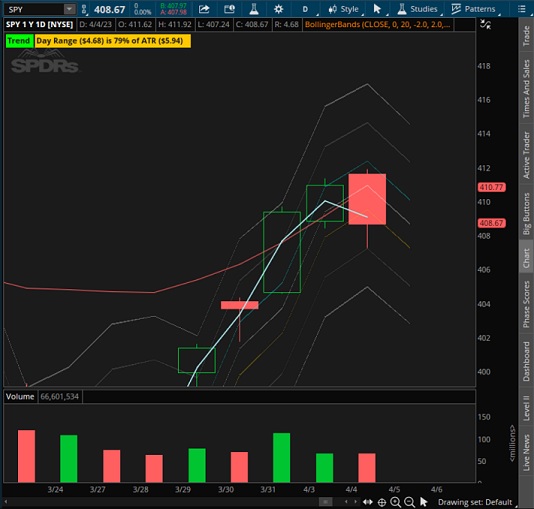

SPX: 4150 top (4137 resistance) / 4050 bottom (break below 4035 next support) / 4100 key level. Still have a gap @ 4030. Watching: SPY: bounce at 407.25 reject at 410-410.5 And ifkyk.  I'm swinging puts for tomorrow (don't follow), I'm targeting 4050. SPY daily chart shows lowering volume while we're making new highs on SPY. So that's a sell signal for me. Not a full sell signal, but enough of one for me to test it out. My position is sized for 0. |

|

|

|

|

|

#37 | |

|

Member

|

Quote:

Thanks.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

|

#38 | |

|

Member

|

Quote:

Of course it now looks as though SPX rejected 4100 two times, so I would imagine Puts might be the play now. I'll leave these comments as is and see which one of the two plays out better. Just realized not only is 4100 the SPX key level, but also is close enough to yesterdays close, I think rejecting off that would be automatic A+ put trade. 10:40, SPX 4090 acting as resistance right now, acted as support yesterday, was resistance prior to yesterday. Hold puts if you are in them.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink Last edited by ajlaxmn; 04-05-2023 at 10:51 AM. |

|

|

|

|

|

|

#39 | |

|

Member

|

Quote:

Calling it a day here. Plays worked out perfectly. I still have some runners for my put swing tomorrow. I want to see 4050. I have sized them to $0 so I will not be monitoring them today - we'll see if we can hit 4050 tomorrow or at least close to it. Remember the market is closed Friday so expect low volume tomorrow heading into the holiday. SPX: 4100 key level - key level + last close✅ SPY: bounce at 407.25✅ - bounced it almost to a T. missed by 2 cents. I'm swinging puts for tomorrow (don't follow), I'm targeting 4050✅- so far so good.   Education: I patiently waited for that 4100 reject - key level + last close I went in full position - this should be automatic without even thinking about it. You can see SPY's 2nd volume bar that buyers losing momentum, then SPY's 3rd volume bar shows that sellers are stepping in strong = hold put position. I did take the SPY bounce @ 407.25 for a quick scalp while holding put SPX puts. You can make money both ways while holding your main position just don't get them confused. My remaining position in SPX are free runners. Free meaning if they go to $0 I don't care as profits have been secured. As a refresher, you don't have to think, you automatically buy calls at support and puts at resistance. They are always sold A+ setups even if they don't work out.

|

|

|

|

|

|

|

#40 | ||

|

Member

|

Quote:

Quote:

|

||

|

|

|

|

|

#41 |

|

Member

|

Based on 4080 open.

Bottom 4050, Top 4150, Key Level 4100

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#42 |

|

Member

|

Thursday is the new Friday. I still have my 4100 put runners from yesterday, so I will be watching the 4030 gap on SPX to get filled (or get my puts ITM at least. I expect low volume today so any trading I do will probably be half of my normal position.

Market is closed tomorrow so it could be a fun day. SPX: 4100 top (break above 4130 next resistance) / 4000 bottom / 4050 key level. I want to see this gap @ 4030 filled. Watching: SPY bounce around 406-405.9. Below there, no good bounces till $403.22. Main reject $410. TSLA: Potential reject around 186.5-187. Anyone who likes equity, I will be adding TSLA equity if it can get down to 170ish area (over the next week or so, won't get there today). If things really get bearish I'll fully add TSLA in the 120's. Last edited by Blazed; 04-06-2023 at 08:32 AM. |

|

|

|

|

|

#43 | |

|

Member

|

Quote:

EDIT: Pretty sure I just realized what I am doing wrong. Live and learn.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink Last edited by ajlaxmn; 04-06-2023 at 09:55 AM. |

|

|

|

|

|

|

#44 |

|

Member

|

4075 acting as intra day support. Again I am on TOS mobile, so I can't see any good bands as I haven't loaded them. 4075 was support yesterday.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#45 | |

|

Member

|

Quote:

I did close my put swing out for a $500 gain. Didn't get the gap fill or ITM, but closed out in the green.  Enjoy the long weekend and it would be a good time to get in some additional education since the market is closed tomorrow. Back at it Monday. |

|

|

|

|

|

|

#46 | ||

|

Member

|

NFP data is going to light up the fireworks tomorrow. Check the SPY daily volume. The stage is set up for the move. Next week should be fun.

----------------------------- Also got 2 good questions: Quote:

For example, my 405.9 bounce for today was yesterdays low and my 410 reject was a support level earlier in the year. SPY stayed in that zone today and hit pretty close to the bounce and reject.  I take about 15 or 20 mins in the morning marking levels and scanning a few weighted stocks to see if they look weak or strong. Personally I like to use the daily time frame - higher time frames longer trades. Yellow lines: Top is 411.5 Middle is 410 Bottom is 405.9  ------------------ Quote:

Break down - I sold 30 calls (3,000 shares) @ the 170 strike for $28.00/call that expire Jan 17th 2025. I went 2 years out to collect the call premium of $84k. I'll let the calls ride and I'll check on them in about 6 months. Not in a rush to buy them back but if AAPL takes a big dip I'll look into buying them back, otherwise, I'll wait until close to expiration (because the closer to expiration the cheaper the calls get as long as AAPL is below $170) then buy them back for a fraction of what I sold them for - which is why you want to sell calls at highs/all time highs. I sell calls more often than puts, I like to wait until a stock hits all time highs or gets a pop off earnings/good news, then buy them back in a month or 2 then repeat the process. To do this, you have to be approved by your broker and its 100 shares = 1 call. So you need to have a minimum of 100 shares. |

||

|

|

|

|

|

#47 | |

|

Member

|

Quote:

I feel TSLA at $120 would be a huge bargain. |

|

|

|

|

|

|

#48 | |

|

Member

|

Quote:

On the flip side payrolls could surprise and we pump, so we'll see. |

|

|

|

|

|

|

#49 |

|

Member

|

Based 4080 open.

SPX Bottom 4050, Top 4150, Key Level 4100 (Gap to 4100, maybe fill off the open) Blazed, is it correct stating their is a Gap when both Call/Puts have low O/I? Well disregard the above. Haha. One of these days I'll get it.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink Last edited by ajlaxmn; 04-10-2023 at 08:29 AM. |

|

|

|

|

|

#50 |

|

Member

|

Should be an interesting week, banks start reporting earnings on Friday

On SPX 4100 is key. We need to break that to see any more bullish runs. SPX: 4100 top (break above 4130 next resistance) / 4030 bottom / 4050 key level Watching: SPY bounce 406 area SPY reject 409 area My main SPY bounces @ 403.72 and 401. Main reject @ 410-410.5. Also. TSLA is on track to hit my first price target of 177. Break that we should test 175.7. |

|

|

|

|

| Bookmarks |

|

|