|

|

|||||||

| Off Topic This section may contain threads that are NSFW. This section is given a bit of leeway on some of the rules and so you may see some mild language and even some risqué images. Please no threads about race, religion, politics, or sexual orientation. Please no self promotion, sign up, or fundraising threads. |

|

|

|

Thread Tools | Display Modes |

|

|

#2226 |

|

Member

Join Date: Jul 2011

Posts: 1,760

|

TSLA gap @ 233.20 and around 213.20 I believe, as of now potential bounce at 218.50-219 (looks like a solid level on the daily + 200ma hr)

|

|

|

|

|

|

#2227 |

|

Member

Join Date: Jul 2011

Posts: 1,760

|

Services and manufacturing PMI @ 9:45 est

New home sales @ 10:00 (No trades before then, and waiting 15-20 min to see how volume and the market reacts) SPX top 5550, key level 5500, bottom 5450 SPY watching 547 area LMT beat earnings, but looking overbought on every timeframe |

|

|

|

|

|

#2228 |

|

Member

|

A lot of data today so keeping it simple today.

9:45 PMI, 10 new home sales, and results of the 2 and 5 year auctions @ 11:30 & 1. SPX: 5500 main watch + ATRs + key levels.

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

#2229 |

|

Member

Join Date: Jul 2011

Posts: 1,760

|

5472.75 intraday support for a quick scalp of $40 @ 10:20. Exit would have been a break below. Holding support + cheap OTM calls being bought were my indicators. Just watching whole psych now since we are outside of ATR's.

|

|

|

|

|

|

#2230 | |

|

Member

|

Quote:

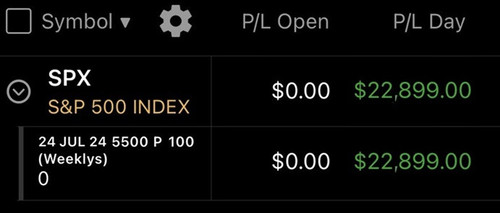

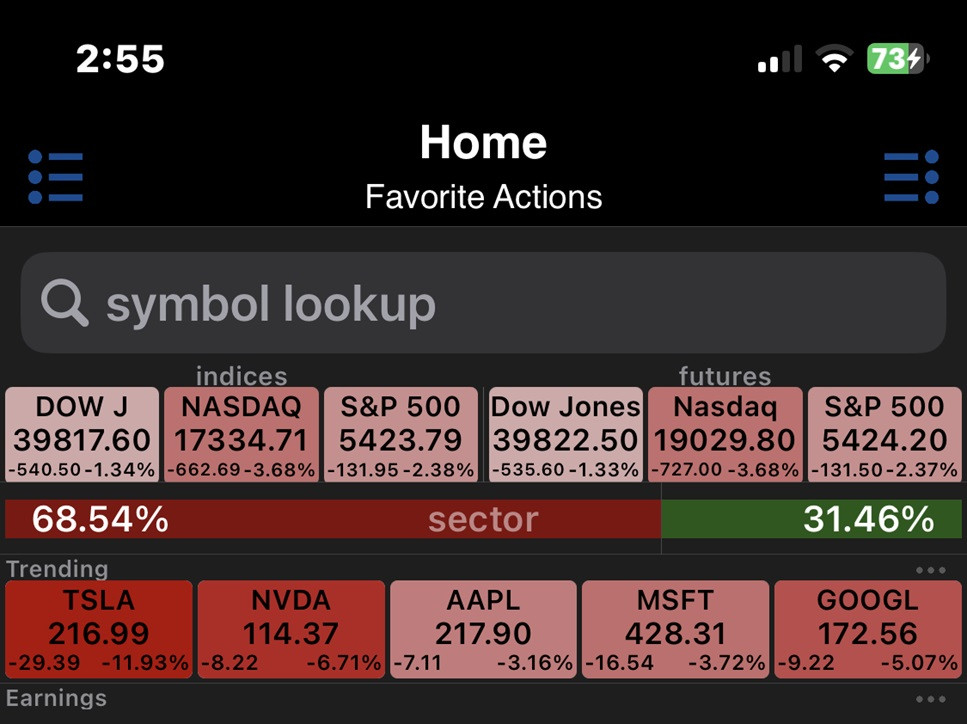

Great day today, calling it a day here. I will not be trading the rest of the week as I will be catching a flight later and heading to the National with my son. I'll be there until Sun and flying back Monday so won't be trading until Tuesday. Enjoy the rest of the week and trade smart. Back at it on the 30th. SPX: 5500 main watch✅- entered puts @ break below. All out, no runners.  Entry @ break below + retest. My absolute favorite setup and one of the easiest setups to recognize. I'm all about keeping it simple, doesn't get any more simple than that.  Gains from this trade. What other job can you make $23k in a sweat shirt and shorts in about an hour? Follow along in this thread all the info to learn is in here free.

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

|

#2231 | |

|

Member

|

Quote:

Won't happen today, but when TSLA loses 200 it has a long way down. Still expecting to get my equity add this year.

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

|

#2232 | |

|

Member

|

Beautiful day.

Big data tomorrow. Should get a relief bounce then next leg down.   ------------------------------------------------------- Quote:

From $1,700 > $2,200. Make sure to manage them if you can't afford to take an L. Hit 540 today. Expect a bounce then more downside. MSFT META & AAPL can change those expectations. Check the daily > weekly. Long way down if SPY next support level.

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

|

#2233 | |

|

Member

|

Quote:

$14 Fill for me, up $800 a contract. Looking at 533.12 and 524.78 for next support Weekly/Daily. Probably would cut one contract here. Looking to hopefully have two runners, wish I had got 5 contracts, but happy with the four I have.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink Last edited by ajlaxmn; 07-25-2024 at 08:23 AM. |

|

|

|

|

|

|

#2234 |

|

Member

|

5400 Bottom, 5425 Support, 5450 Key, 5475 Resistance, 5500 Top

GDP beat expectations. waiting 15min before trading. SPY Reject 543.20 SPY Bounce 539.43

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#2235 |

|

Member

Join Date: Jul 2011

Posts: 1,760

|

Nice! Watching these areas and sitting out the first 15 minutes too. 5426 is also 4hr 100ma. Probably won't get there today since it's outside the implied bottom but I think we still have 5376 gap too.

|

|

|

|

|

|

#2236 |

|

Member

Join Date: Jul 2011

Posts: 1,760

|

Hope you caught that move down, I was fooling around with the limit order and missed it. I wanted to get in at the retest. Flow was selling. Looks like we have a trend day with that volume candle so will be looking for puts on pops. Haven't had one of those in forever lol.

|

|

|

|

|

|

#2237 |

|

Member

Join Date: Jul 2011

Posts: 1,760

|

Well got cooked on puts today

|

|

|

|

|

|

#2238 |

|

Member

|

Me too brother. I'll post synopsis tonight, I know what I did, and I'm pretty sure I made this mistake once before.

$400 loss on the day. Still money I can afford lose, and I learned. I'm sure you did too. Sucks because today was a good day with movement, initially with Puts, then with Calls.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#2239 | |

|

Member

Join Date: Jul 2011

Posts: 1,760

|

Quote:

|

|

|

|

|

|

|

#2240 |

|

Member

Join Date: Jul 2011

Posts: 1,760

|

Consumer Sentiment @ 10 (No trades before then for me)

SPX top 5500, key level 5450, bottom 5400 SPX 4hr 100ma @ 5428.50 |

|

|

|

|

|

#2241 |

|

Member

Join Date: Jul 2011

Posts: 1,760

|

Market adjusted and SPX bounced right off the 4hr 100ma this morning. That was a nice move up to the key level before data even released. I didn't take it as I was waiting for data to drop. I ended up losing $160 on 3 SPY calls at the close of the 10:05 SPX 5 min candle, but I will work on a write up to post tonight as well. Looks like they are just working to kill premiums on both sides atm

|

|

|

|

|

|

#2242 |

|

Member

Join Date: Jul 2011

Posts: 1,760

|

What/when I traded: 3 SPY 544C contracts @ 11:34:09 (est)

Thought process and reason for entering trade: I was waiting patiently for 5450 whole psych # or 5500 (5490 area has been a strong resistance now the last three days and served as strong resistance in mid-late June). No early entries and no chasing today either. If the whole psych hits then it hits, and if I miss it then I miss it. I've realized chasing or entering early can amplify your losses and it can negatively impact your profits in a big way so I'd rather miss a trade completely than entering early. 5444 ATR was right below as well for a safety net. Trend at the time was red so I was going against it (trend is still important at a whole psych, but less important than in between levels). However, sellers were continuously slowing and there was low volume on the 10:30, 10:45, and 11:00 SPY candles (less than 1 million). Buyers were stepping in and stronger than the 11:00 sellers candle too on the 11:15 candle close. The 11:31 and 11:32 1 minute SPX candles would have been a great and honestly the ideal area to enter using the 5 minute close below the SPX 5444 ATR as a stop out. This time I waited a couple minutes after though thinking that we had 5444 ATR right below as my safety net anyway (not something I probably should do). I thought with SPX MM's love to drive the price right below or right above stops before going the way you wanted, so I waited those 2 extra minutes when it was below where I would have normally gotten in based on the 11:31 and 11:32 set up using the same exact stop out area and therefore in my mind positively changing my potential gains or losses. Exit plan: Cut if SPX 5 minute candle closes below the 5444 ATR. If not, trim/sell at a 10 pt move or 5459 ATR. Where I sold: I ended up selling at the 5459 ATR (I had to rush out this afternoon and couldn't actively manage my position so I closed it out). However, the 5 minute 11:45 SPX candle had closed above the 5459 ATR indicating a "stay in position" thought process with a close out at the break below. We were also pumping on low volume at the 11:45 SPY candle. VWAP would have been a great trim spot to lock in gains as well. Total gain for the day $150. |

|

|

|

|

|

#2243 |

|

Member

|

Consumer Confidence & Home sales at 10, no trades until then.

Top 5520, Key 5500, 5490 Resistance, 5550 Support, Bottom 5420. Really only going to watch 5500 and 5500 + ATR's. SPY 547.23 reject SPY 542.69 bounce

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#2244 | |

|

Member

|

Quote:

MSFT / AMD / SBUX after the bell and FOMC tomorrow.

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

|

#2245 |

|

Member

|

ATR right at key level

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#2246 | |

|

Member

|

They dumped MSFT off the news

MSFT is also looking like a sell for earnings based on flow Quote:

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

|

#2247 |

|

Member

|

Didn't catch anything off the move. Was waiting for SPX previous close, didn't hit, didn't trade. I can't remember the last time a consumer confidence spiked buying, always seems to spike selling, ALWAYS. I'm always tempted to take one contract just for a quick scalp, but better thad I don't.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#2248 |

|

Member

Join Date: Jul 2011

Posts: 1,760

|

10:17 sales, flow looks to be moving opposite volume?

|

|

|

|

|

|

#2249 | |

|

Member

Join Date: Jul 2011

Posts: 1,760

|

Quote:

|

|

|

|

|

|

|

#2250 |

|

Member

|

pushing down off low volume, not looking for puts.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

| Bookmarks |

|

|