|

|

|||||||

| Off Topic This section may contain threads that are NSFW. This section is given a bit of leeway on some of the rules and so you may see some mild language and even some risqué images. Please no threads about race, religion, politics, or sexual orientation. Please no self promotion, sign up, or fundraising threads. |

|

|

|

Thread Tools | Display Modes |

|

|

#1901 |

|

Member

|

Unemployment claims jumping gave the market a little push.

SPX: 5200 key level / 5230 top (resistance 5212/15 area) / 5150 bottom (break below - gap @5139) SPY: 520 reject.

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

#1902 | |

|

Member

|

Quote:

First trade - tested puts as we approached this level (should have waited but front ran it because it's whole psyche and a solid area) and they pushed it up completely ignoring 5200. Took a $2.1k loss. Cut when SPX broke above 5208 and they started chopping this area. Second trade - Took calls @ the retest of 5200 and started chopping, finally got a push up to 5206/07 and sold. Gains of $630 on this trade. Crazy. --------------------- Still have my put swings for OPEX - win or lose, no plans to do anything with them until OPEX.

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

|

#1903 |

|

Member

Join Date: Jul 2011

Posts: 1,759

|

Lots of news/data- I may just get some screen time in and monitor today.

SPY: Watching closely, 520 - 520.50 area based on 4hr chart SPX: Watching 5230 area based on daily Last edited by lane121; 05-10-2024 at 08:21 AM. |

|

|

|

|

|

#1904 |

|

Member

|

SPY 523.7 for a reject (4 hr & daily)

SPY 520.2 area for bounce SPX Bottom 5200 (break below 5190)(5225 Support), Top 5280 (resistance 5260/65), Key 5250 Lots of fed speakers today, I'd trade light in the even they move market.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#1905 |

|

Member

|

They're running the market up based on Fed cutting rates vs. hiking.

If you check the daily volume on SPY its low. So we're pushing off low volume. IYKYK. Consumer sentiment @ 10 and Fed speakers all day. SPX: 5225 key level (gap @ 5215.3) / 5250 top (break above > 5265/67) / 5180 bottom (support @ 5200 > 5195/90 Check the daily - SPX is overbought. Watching: SPY: calls if it can hold 521.4 NVDA: calls above 903.7 META: bounce @ 475 area Market is trading illogically right now so A+++ setups only or no trades.

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

#1906 |

|

Member

|

This is also a good idea. Might do the same.

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

#1907 | |

|

Member

|

Quote:

All out here before consumer sentiment SPX: 5225 key level✅  NVDA: calls above 903.7✅  Now watching what CS does

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

|

#1908 |

|

Member

Join Date: Jul 2011

Posts: 1,759

|

Followed my plan for entry - watching SPX 5230 - and bought 5 puts when the 1 minute SPX timeframe closed below 5230 and broke below the 5227 ATR around 9:11. It may have been another tight stop, but I was using the 5230 on SPX as my mental stop after that time. SPX bounced a little above the ATR, but it did not close above 5230, so I held on to my position and ended up selling on the drop below the ATR again for a $300 profit today. Though- I did not hold all the way to the 520 - 520.50 SPY area I was watching.

Last edited by lane121; 05-10-2024 at 10:00 AM. |

|

|

|

|

|

#1909 | |

|

Member

|

Quote:

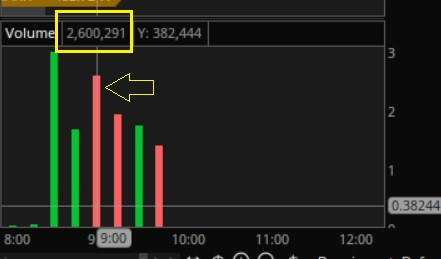

Check the daily - SPX is overbought✅ volume on SPY its low. So we're pushing off low volume✅  Got in puts @ the break below 5227 ATR. Then got the reversal signal 2.6m   All done for the day. Time to enjoy the weekend, back at it Monday. Next week should be fun with CPI + OPEX.

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

|

#1910 | |

|

Member

|

Quote:

Get a good system going > results will follow. Patience and consistency will lead to longevity in this game.

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

|

#1911 |

|

Member

|

5/10 – Got into SPY 522 P when SPX broke below 5227 ATR, SPY was showing sellers stepping in with enough time on 15m candle to close above 2.5M for reversal. Five contracts, trimmed 3 at 520.2 support level I had, one at 520.2 when it continued to bounce and SPX hit last close, stopped out on runner that I set in profits. Filled contracts at $1.08 per. When put more money back into my account, I’ll be trading SPY, 5 contracts at a time.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#1912 |

|

Member

|

Added some ZK equity @ $26.95. Only 200 shares to start just to have them. Seems to be TSLA's only real competitor for now.

Watching to see what it does, if it pulls back after the IPO excitement is over I'll add another 800 shares.

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

#1913 | |

|

Member

|

Quote:

You'll notice a big difference when you switch back to SPX after practicing level to level w/ SPY and getting used to letting the trade play out longer.

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

|

#1914 |

|

Member

|

My account will appreciate it as well, losing $150 is more tolerable than $500-700. Probably going to focus on SPY for the remainder of the year, start with SPX next year. Maybe would consider SPX earlier (septemberish) if I really start nailing SPY trades down.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#1915 |

|

Member

|

A lot of important data this week. CPI weds and OPEX Fri.

SPX: 5250 key level (need to break and hold to continue higher) / 5275 top / 5285 bottom (support 5200 > 5195/90) Watching: SPY: 524.11 reject. Only reject I like in this area. Will mostly be watching today, not really looking to trade. Main watch SPY 524. Be patient, let trades play out if you take any, and don't force anything.

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

#1916 | |

|

Member

|

Quote:

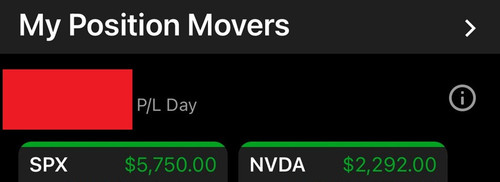

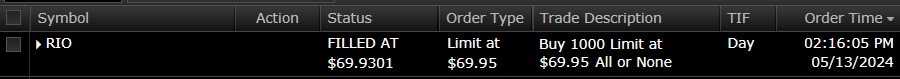

No trades today. It chopped as expected. Could possibly do the same thing tomorrow. ---------------------- Added equity in RIO. Nice quarterly setup (check the charts) I've been watching it for about 2 weeks. Risking about $10 a share to potentially make $30+

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

|

#1917 | |

|

Member

|

PPI came in hot

Powell speaks today @ 10. This should be good. Quote:

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

|

#1918 |

|

Member

|

They bought the dip all the way back up.

Powell @ 10 SPX: Only watching 5250 / 5200 + ATR's Watching: SPY: reject @ 522.7 & a bounce @ 518

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

#1919 |

|

Member

|

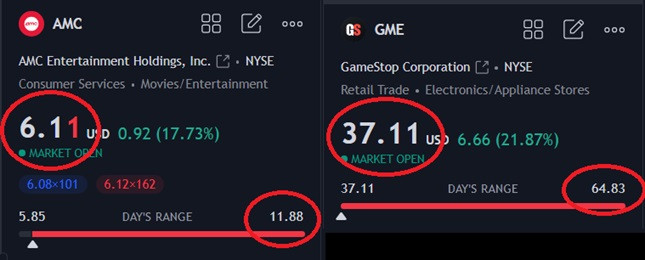

No trades today, range is terrible.

However, it was fun watching the meme traders on AMC/GME get smoked All the calls bought this morning that expire Friday with the thought of "to the moon" was crazy.

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

#1920 |

|

Member

|

Top 5300, Bottom 5200 (5220 support, 5250 Support), key Level 5280, Gap 5250.37

SPY 523.11 bounce SPY 527 reject ATH's, so I'm going to primarily watch psych numbers and ATR's.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#1921 |

|

Member

|

CPI dropped, no surprise that the data was manipulated. Liz Saunders posted charts of stuff they removed from the data and they removed all the stuff that was causing inflation to be high

Election year, so it is what it is. SPX: ATR's + 5300 Watching: SPY bounce 524-524.6 area, and reject @ premarket highs 527 (possibly a scalp) as the market in on full TILT mode. Take what the market gives, be patient and don't force anything.

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

#1922 |

|

Member

|

5/15/24 – Got into 527 Puts when SPX kept rejecting ATR in addition to SPY holding below same ATR. Volume was green but SPX rejected on the 1m multiple times, in addition to being overbought along with SPY being overbought. Second SPY candle closed 2.5M and red, signaling reversal. Cut two contracts at bounce of opening print, wish I had cut three instead. Got out of position when SPX broke above 5277 ATR as it had rejected multiple times earlier in the day AND rejected prior to finally breaking above. $20 profit, but managed my position satisfactorily. Really enjoying trading SPY, still papertrading, but enjoying it.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#1923 |

|

Member

|

Also got one 536 C with 6/28 expiry, filled at $3, now it's at $5, don't care if I hold too long and expires worthless. purchased it purely out of speculation of getting to 550 before 6/28, nothing besides that, money I can lose.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#1924 | ||

|

Member

|

Quote:

Quote:

I like the month out swing!

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

||

|

|

|

|

|

#1925 |

|

Member

|

Didn't take any trades yesterday. Took too long to get to my levels. I think it finally hit 5300 around 1pm my time.

SPX: 5300 key level / 5250 bottom (5270 support & gap @ 5250.3) / 5350 top (break above 5353) Watching: SPY: bounce @ 528.6 or uptrend entry above 530.8

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

| Bookmarks |

|

|