|

|

|||||||

| Off Topic This section may contain threads that are NSFW. This section is given a bit of leeway on some of the rules and so you may see some mild language and even some risqué images. Please no threads about race, religion, politics, or sexual orientation. Please no self promotion, sign up, or fundraising threads. |

|

|

|

Thread Tools | Display Modes |

|

|

#151 | |

|

Member

|

Quote:

You've really come a long way in the few short months you've been applying what you've learned. If your ultimate goal is to do this full time - you'll be getting to that point in no time. And for everyone else, this is exactly why I do this and post ideas/trade recaps instead of just posting "bought TSLA at the open"... You get out of it what you put into it and ajlax is proof that it's definitely a learnable skill if you put in the work and don't just follow ideas that are posted. Those of you I work with through DM's, I hope one day you'll have the confidence to post your plays here too and get the thread more active. Back at it Monday

|

|

|

|

|

|

|

#152 | |

|

Member

|

Quote:

I would encourage anybody that truly wants to learn this to start watching/participating/learning in this thread. I knew nothing about options in November of last year, other than what they were by definition. I am much more confident now than I ever thought I would be, but I am absolutely getting it and they're will be no stopping for me, their is going to be no "well I'm not interested anymore, I am 100% committed to this, but it didn't happen over night (though I will admit I have discipline and routine in other aspects of my life that have made this commitment much easier).

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

|

#153 |

|

Member

|

Based on 4163 open

Bottom 4100, Top 4185, Key Level 4150 (Support at 4140 > 4130) Gap at 4075.1, from last Friday. SPY Puts 418.4 SPY Calls 414.1, break below 410.3

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#154 |

|

Member

|

SPX: 4200 top (4195 resistance) / 4100 bottom (4110 support) / 4150 key level (4170 resistance)

Watching: SPY bounce 414 for calls SPX 4200 reject for SPY or SPX puts TSLA calls over 165 puts under 162.6 |

|

|

|

|

|

#155 |

|

Member

|

No entry for me yet. I guess 4170, or rather 4165 call should have been the play once we broke previous close, I didn't jump into that, and don't want to chase right now, I'll wait for maybe a reject. We have been in uptrend the past two days though, so keep that in mind.

Update: Watching 4170 for possibly turning support. Update: in 4165 calls, watching SPY 416.75 as possibly resistance for second time, which would result in me cutting my position if it rejects. Update: out of 4165 calls for $230 gain. Held as 4170 was tested multiple times, previous support turned resistance, pretty choppy today and I don't want to sit on this trade and I need to treat it as if it was actual money, which I would not sit and wait an entire day and get killed with time decay. Would maybe consider 2000 Puts if we get up there, but it appears its going to be a slow trudge up there.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink Last edited by ajlaxmn; 05-01-2023 at 09:53 AM. |

|

|

|

|

|

#156 | |

|

Member

|

Quote:

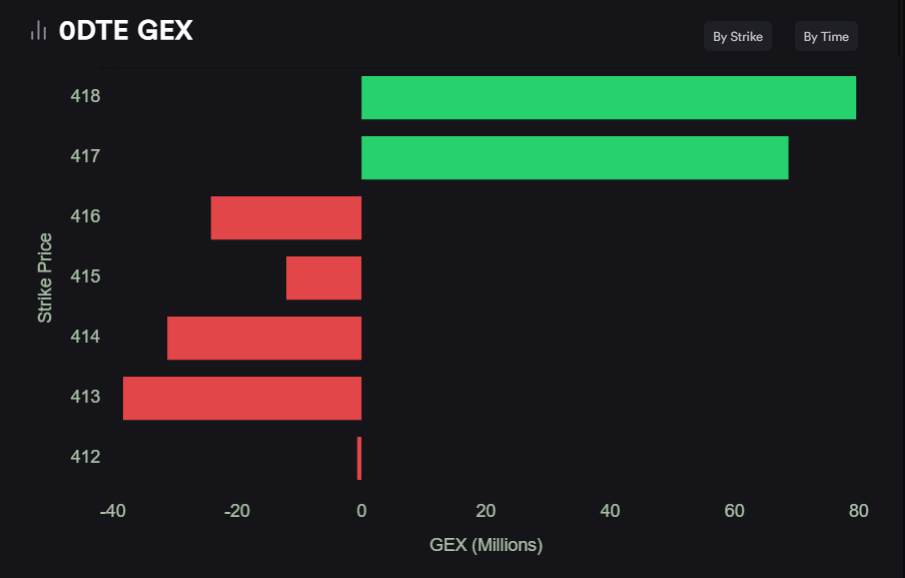

I have 4200 calls for Wednesday. I've been in them since the open @ the break above 4170. Only trade I have taken today. Puts on TSLA off the open worked out too. Fyi - gamma exposure (GEX) for 418 SPY.

|

|

|

|

|

|

|

#157 | |

|

Member

|

Quote:

Had they not made that announcement we should have hit 4200 > 4210 today/tomorrow. Done for the day. |

|

|

|

|

|

|

#158 |

|

Member

|

So can you elaborate on this? I understand Gamma as the change in Delta for each $1 increase in the underlying security. What does this imply? I can't really say I understand it enough to make an educated guess? Their WAS a lot of Option Interest in SPY 418?

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#159 | |

|

Member

|

Quote:

Basically GEX represents dealers requirements to gamma hedge their ports. The data is just showing what exposure of gamma the dealers need to hedge today (0dte), with the exposure being negative or positive it means there are more BTO puts or calls in the market. As dealers are short/long gamma, they are selling/buying the underlying as we drop/pump to hedge their ports. So that's why we see small steps up and elevator down and vice versa. Of course as we saw today, news can change things. Hope that made sense. |

|

|

|

|

|

|

#160 | |

|

Member

|

Quote:

Do you have one specific source for news dropping that you rely on? Yahoo finance? CNN? Fox? I am out of the loop on the news dropping and that seems to impact things and I feel I really need to get in the habit of that as well. Thanks.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

|

#161 |

|

Member

|

Based on 4158 Open

Bottom 4125, Top 4200 (4190 resistance), Key Level 4150 (4170 resistance was previous support) SPY Calls 414.1 SPY Puts 416.1

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#162 | |

|

Member

|

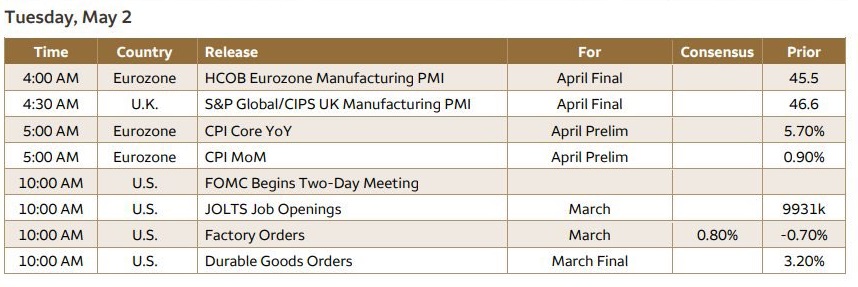

FOMC. So today I will downsize on my contract size. Any news that drops could cause the market to swing in either direction. Data drops @ 10am est time (jolts, factory orders, durable goods), may or may not have any affect today. Powell is tracking JOLTS.

Wait for confirmations and be patient. SPX: 4200 top (4185 resistance) / 4100 bottom (4110 support) / 4150 key level (4170-4175 resistance) 4200 is key today. SPY - Bounce at 414 - 413. Higher probability bounce down at 410.5 - 410. SPY - High risk reject at 415.5 for puts (previous close). Highest probability reject is @ 418.54. After that nothing until 420 (or 4200 on SPX).  Quote:

|

|

|

|

|

|

|

#163 |

|

Member

|

Took 4145 Calls when SPX rejected 4150 multiple times in addition to second SPY 15m candle being lower than previous. Cut when SPX dropped to 4146. Bad trade to take, good decision to cut as their was no looking back for SPX. Very happy with my decision to commit to cutting if SPX moved below 4150.

Blazed I would assume the news that dropped had an impact?

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#164 |

|

Member

|

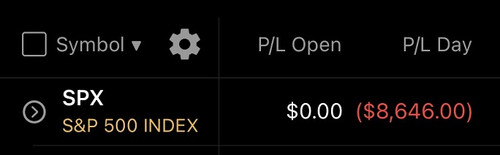

It looks like this dump is from regional bank fears and comments Yellen made regarding debt limit.

Red on the day. Losses are all part of the game and tomorrow is a new day. This is why it's important to manage your risk (especially on small accounts), don't hold a position for hope (I did not do this) and don't fight the trend (I did do this). I clearly tried to fight the trend and took an L. Hope everyone enjoys the rest of their day. FOMC tomorrow. Should be another fun day.

|

|

|

|

|

|

#165 | |

|

Member

|

Quote:

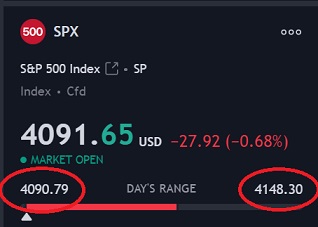

The data drops didn't really have an impact, it looks to be more about the debt limit and bank fears. The flow was opposite of the market this morning. Positive flow with a big sell off. The selling is real, so it was kind of interesting to see that. This is also an example of how MM's trigger a sell off. Once they go stop loss hunting and hit a few, it turns into a domino effect and way down we go - which is why all the levels were blown past. Looks like we found the bottom @ 4090 as of now. |

|

|

|

|

|

|

#166 | |

|

Member

|

Quote:

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

|

#168 | |

|

Member

|

Quote:

|

|

|

|

|

|

|

#169 |

|

Member

|

FOMC today, will not be taking a trade unless it is an absolute A++++ setup before FOMC. Remember, let the market come to you and DO NOT force any trades. Let's get this

SPX - Skipping the open, levels before 2 pm. I'll be trading SPY only if I get an A++++ setup this morning. Game plan for FOMC - We bounced a key pivot area of 4090 yesterday and rallied up from the major drop. Will be watching 4125, above 4134 and 4140, get above 4140 could push, below 4114, 4100, 4090, and 4075, for pre minutes. Once Powell starts talking I'll play zones, personally I like to wait till after minutes drop for IV crush and Powell to come on before taking a trade. If you have a smaller account I would skip FOMC or wait for a top/bottom on SPX to play SPY. Whatever you do trade safe and use risk management. Remember, stops tend to get hunted fast and hard in FOMC so I would try to use mental if possible - I never use a hard stop unless I can't monitor my position. SPY - Reject @ 413.67 - 413.88. Bounce @ 410.2 - 410, then @ 407.82 ------------ If you like numbers and playing mind games with market makers, it's very fun and interesting. |

|

|

|

|

|

#170 |

|

Member

|

Based on 4123 Open.

Bottom 4100, Top 4175 (Resistance 4150), Key Level 4130 Chose 4130 because even though yesterday was a down day, it was only one day and I don't think that this indicates a trend yet (something I very well am stating incorrectly) 4130 has been resistance/support in the past. SPY Calls 410 SPY Puts 414.1 Good learning day for after a significant drop the day before, good to see if market bounces back in the opposite direction.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#171 | |

|

Member

|

Quote:

Best advice is don't play it, just watch. Watch the candles after the data drops, then watch how the market reacts to Powell's speech. SPX - 4200 on watch to go short and 4076 on watch to go long. Good luck. |

|

|

|

|

|

|

#172 | |

|

Member

|

Quote:

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

|

#173 | ||

|

Member

|

Quote:

Quote:

True which is why I'm waiting until we get a direction from Powell. I sat and watched a lot of FOMC meetings before I played one. I didn't start playing FOMC until about a year and a half ago when I realized that SPX levels (top & bottom) hold up good and volume still works. |

||

|

|

|

|

|

#174 |

|

Member

|

Was on my phone so I couldn’t take a trade but I was sitting in traffic at 2:42. I got an alert that said feds were increasing interest rate to 16 year high. I quickly looked over at SPX and I think it was at 4133 at that time, and I immediately told myself I would be in 4140 puts without hesitation. There could’ve been something else that would’ve made that a bad play, but knowing how the market would react, I immediately would’ve tested 4140 points. Now if I was putting actual money on the line, I don’t know but as far as a paper trade, I definitely would’ve taken it.

Sent from my iPhone using Tapatalk

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#175 | ||

|

Member

|

Quote:

Quote:

Calling it a day here, levels hit. Hope everyone enjoys the rest of their day. SPY - Reject @ 413.88✅ - missed it by a penny! I took SPX puts when we hit my SPY reject level. I might adjust the 4076 to 4090/4100 for calls✅ - Hit both levels 4100 & 4090.     What I saw: My SPY reject level lined up perfect with SPX 4050 so I grabbed puts. Volume also confirmed that we had some downside coming. Exited puts @ 4100 and grabbed calls. Every single trade I took was based off my levels. No jumping in trades just because, no chasing, I waited for a level to hit then got in. That is how you keep your trading days green instead of red. Paytience pays.

|

||

|

|

|

|

| Bookmarks |

|

|