|

|

|||||||

| Off Topic This section may contain threads that are NSFW. This section is given a bit of leeway on some of the rules and so you may see some mild language and even some risqué images. Please no threads about race, religion, politics, or sexual orientation. Please no self promotion, sign up, or fundraising threads. |

|

|

|

Thread Tools | Display Modes |

|

|

#126 |

|

Member

|

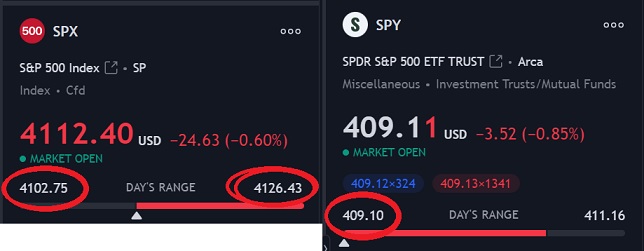

Based on 4117 open.

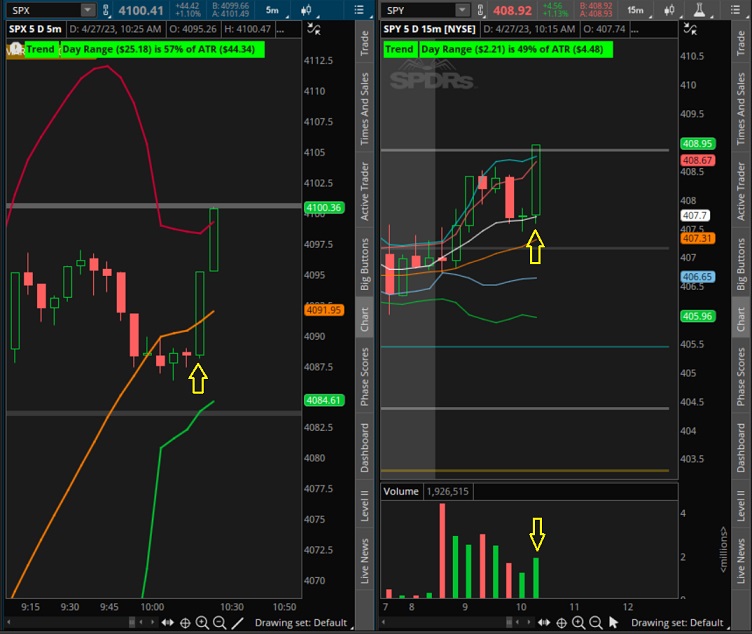

SPX Bottom 4075 (O/I 3k), Top 4170 (Resistance 4130) (Break Above Top > 4180 > 4190 > 4200), Key Level 4100 (O/I 5k) SPY Puts 413, held yesterday for a sell off SPY Calls 410.3, held multiple times overnight in addition to holding previously as support

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#127 | |

|

Member

|

Quote:

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

|

#128 |

|

Member

|

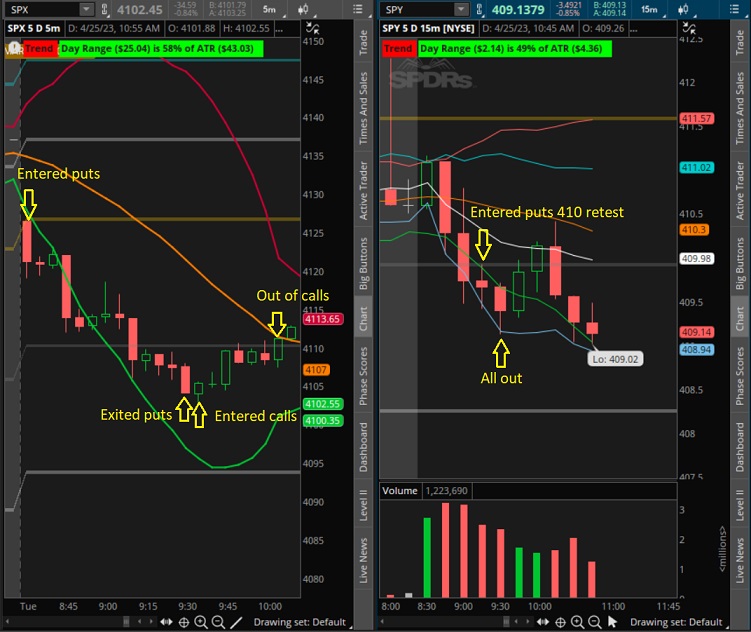

Initially took 4115 Calls, saw it was not going to move up, took calls based on SPY volume on first 15m candle plus SPX holding 4120 as support. When I cut I took a $30 loss, but then immediately took 4125 Puts based on 4120 reject and SPY 411 rejection (which had also acted as resistance overnight), followed SPY volume down to 409 then cut for $500 gain. Not a bad little trade.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#129 | |

|

Member

|

Quote:

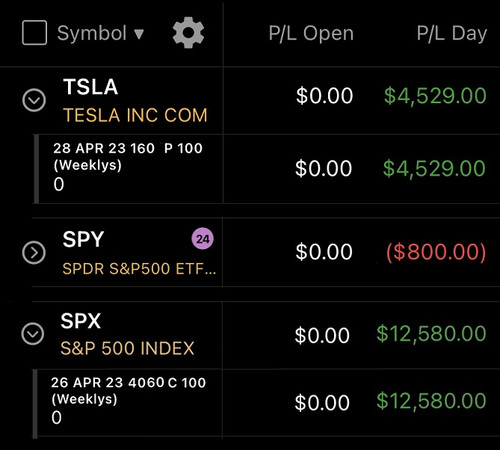

Calling it a day here. Posted my exact plays that I was going to take and they paid. SPY watching both ways - 410 is holding SPY up. I’m looking to fail 410 and retest for puts entry.✅ - this worked out to a T. We broke below 410 and came back for a retest, rejected it as expected and took a nice $1 move down. SPX: 4130 key level✅ - took some 4030 puts when I saw SPY and SPX divergence. Divergence = SPY was pushing up and SPX was pushing down off the ATR 4127 level. SPX: 4100 bottom✅- took the 4100 bounce and exited at the next ATR level 4110.5.   Education: SPX/SPY divergence  SPY/SPX entry/exit  Extra Education: TSLA - the reason I have been focused on TSLA here is because someone followed someone else's trade (who clearly didn't know what they were doing) posted in another thread and is sitting on a loss right now and asked me to look at TSLA and how I would trade it. Stop blindly following other peoples trades, look at the charts and see where the next resistance level is. See how much room you have to go up/down instead of just entering a trade someone posts. A few things I've noticed from DM's I get: Clean up your charts - I've been sent screen shots that I can't even follow because there's so much stuff on them. Seriously, the whole "less is more" is real in trading. You don't need 13 indicators and 27 lines to confuse your mind. You need to wait until your levels hit and stop being in a rush or try to force/chase a trade. Higher time frames = longer trades. I have never looked at the 1 min time frame. Use weekends to study - instead of endlessly scrolling though TikTok/FB/Instagram, use that time to learn a new skill. Your cell phone is a money making machine, use it. Trading is a job that truly offers job security. The market isn't going anywhere and the sky is the limit as far as earnings. Cut the noise - Stop listening to other people's opinions. If you keep listening to the 90%, you will never be part of the 10%. Stop comparing yourself to others, focus on your own journey. Trade your systems, trade your plan, trust yourself and skills, not others. Get your confidence up - I had a DM where the levels were being market right, but was afraid to pull the trigger when they hit. Stop being afraid to take a loss. If you wait until levels hit, look for confirmation as levels approach, you will not take that many losses. I very rarely take an L because I'm patient and wait to take a trade based off my levels. Without confidence you'll never make it in this game. It's 90% mental 10% skill, stop over thinking everything. It doesn't matter if your trading options or equity, all the moves they make are based off of technicals. This is why it's important to be able to read and understand technicals. I post my gains for motivation so people can see - people like to see actual results - so if you put in the work you can do this on the side or full time. Hope some of that helps, I'll try to post more tip and stuff. Hope everyone enjoys the rest if their day. |

|

|

|

|

|

|

#130 | |

|

Member

|

Quote:

|

|

|

|

|

|

|

#131 | |

|

Member

|

Quote:

Thanks again.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

|

#132 | |||

|

Member

|

Quote:

Quote:

Quote:

|

|||

|

|

|

|

|

#133 |

|

Member

|

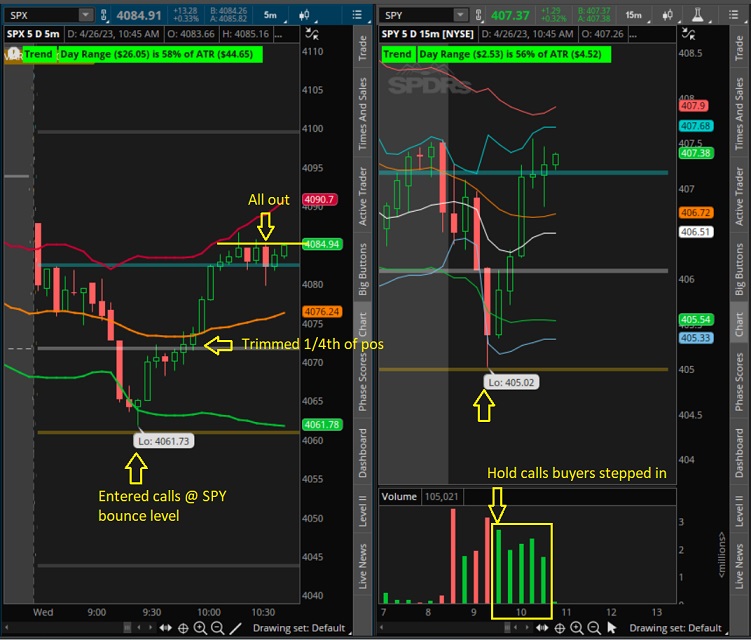

Based on 4085 open.

SPX Bottom 4050, Top 4140 (break 4150), Key Level 4080 (acted as support late yesterday) SPY 405.9 Calls Have to run to meeting, no time for Puts analysis

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#134 |

|

Member

|

SPY flushing right now @8:23 so lets see what the market gives. Nice earnings by MSFT not moving individual stocks too much though.

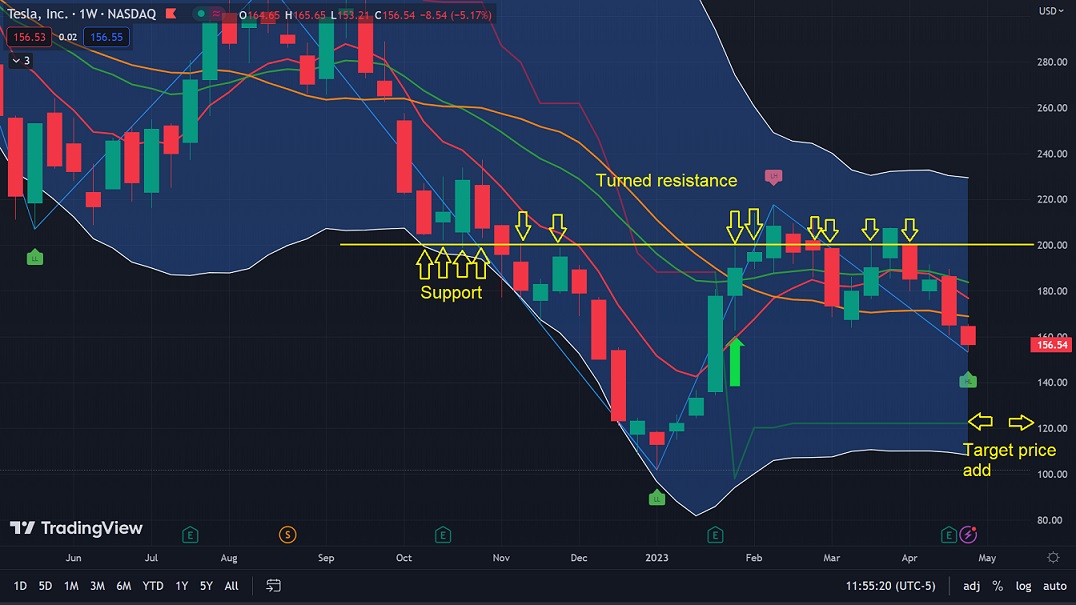

SPX: 4150 top (4130 resistance) / 4050 bottom (4080-4075 support) / 4100 key level Watching: SPY - reject 410 for puts SPY - bounce 404.5 for calls WMT - 150 bounce for calls (supertrend / 100SMA bounce) TSLA - Sitting at a bounce level of 160. Watching this area closely. Under 160 on watch for confirming a downtrend, a break and hold down there has a large gap down. Equity add @ 150 and I will be selling calls against my shares. GOOG - earnings weren't nothing to write home about. So I expect to see GOOG dip today. Trade smart, wait for entries and don't force. |

|

|

|

|

|

#135 | |

|

Member

|

Quote:

4080 acted as resistance, and SPX dropped.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink Last edited by ajlaxmn; 04-26-2023 at 09:23 AM. |

|

|

|

|

|

|

#136 | |

|

Member

|

Quote:

Trade recap: I guess these slow mornings of chop are going to be the new thing the MM's do now. Took an L on SPY as I didn't like my entry so I just cut it. But TSLA & SPX paid. TSLA - Sitting at a bounce level of 160. Watching this area closely. Under 160 on watch for confirming a downtrend✅- took puts as TSLA broke below 160, so close to 150. We should see 150 soon then 120 later on.. SPY - bounce 404.5 for calls✅ - Strong support level. I took calls early @ 406, looked like a new base level, I was wrong and we dropped so I cut to look for a better entry. SPX - 4080-4075 support✅ - worked out for scalps (trend was down, selling was strong, no reason to go long at that point), but the best area for calls was 4060. 4060 lined up with SPY 405, this bounce paid as the calls exploded after we broke above 4070. 405/4060 were also both ATR levels.   Education:  Learn how to read the technicals. See chart below. I got some DMs on this yesterday after my post about TSLA. Example, buying TSLA at the open on 4/5 @ 195-200 means 2 things, didn't bother looking at charts or cant read read charts. Daily chart at that point showed TSLA was going to reject off the supertrend as 200-201 was a strong resistance level. The weekly chart showed the same thing. Once TSLA rejected the supertrend and broke below the 8 & 21 EMA's it's been going down and has room to 120. A few support levels in between (150/145 area). and a supertrend/strong support level around 120 area which is why I'm watching that area for a full add. This is what the Bollinger Bands are for. Top band/mean/bottom band all mean something. A stock can not trade outside of the bollinger band for very long. It has to come back inside. Selling calls against your shares: Right now my cost per share of TSLA equity is 151 after selling calls towards my first add @ 170. When we get down to 150 I'll buy my calls back, and I'll add more equity then sell calls against shares. If we get to 120 I'll buy my calls back, and I'll add my full position, I won't sell calls here, I'll sell puts depending on where we are on charts and economy. That's how you average down your cost per share while adding at major levels. TSLA is one of the BEST stocks to do this with because the option premium is high. Let your shares work for you. With the exception of data drops/bad news/good news, all stocks move based off of technicals intraday. Learn to read them and scan the different time frames. 1 hour 4 hour Daily Weekly Those are the time frames for longer trades when trading options or day trading stocks. For equity adds I use the daily & Weekly to get the best fills. Hope everyone has a good rest of their day.  ---------------- edited to add 4050 bottom (4080-4075 support)✅ bounced @ 4050 as expected. Gotta learn levels, it makes trading so much easier.

Last edited by Blazed; 04-26-2023 at 04:23 PM. |

|

|

|

|

|

|

#137 |

|

Member

|

Based on 4080 Open

SPX Bottom 4030 (break below 4020), Top 4100 (4100>4110>4120 Resistance), Key Level 4075 SPY 404.3 Calls SPY 409.9 Puts

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#138 | |

|

Member

|

No bias today, take what the market gives and be patient.

SPX: 4100 top (4080 resistance) / 4030 bottom (break below > 4020) / 4050 key level Watching: SPY - Watching for a reject at 408.5 - 409. Highest probability reject at 410 (if you have a small account wait for this level). 405.5 - 405 for a bounce. and TSLA. Looking for TSLA to pop off the open and reject around 155. Quote:

|

|

|

|

|

|

|

#139 |

|

Member

|

I got back to my screen five minutes late when the first SPX candle had closed. Saw it bounced 4075, not the correct key level based on Blazed post, but I was going to take that (papertrade) if it bounced or rejected. Seems it would have worked out for a nice little gain early. However it might have been luck, i'm on TOS online so I don't have other indicators loaded, will evaluate tonight.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#140 | |

|

Member

|

Quote:

Good job on catching the 4075 bounce

|

|

|

|

|

|

|

#141 |

|

Member

|

No trades for me yet. Waiting on 4100/409 and see what we do there. We're in an uptrend with low volume, low volume pumps can screw you as it will slow grind up all day. But if we can touch 4100 with low volume I'll test puts and cut if we break above 4103. As of now it looks like they're not going to give us 4100/409. No early entries today.

|

|

|

|

|

|

#142 | |

|

Member

|

Quote:

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

|

#143 |

|

Member

|

4075 was the play today! You had the better levels today that's for sure - I love seeing this suff. I like how you thought and arrived at your levels, you killed it today. This is why I say "trust what you see" and while its ok to compare, follow your plan and adjust only if you see something you missed or anything changes intraday.

|

|

|

|

|

|

#144 | |

|

Member

|

Quote:

So, did anyone catch the huge pump around 11:15e time? Dealers needed to hedge positive exposure, means pump. To hedge positive exposure the dealers must buy the underlying, driving price up which is why we pumped all day on low volume. [  No trades from me today. I wasn't going to chase the pump because it can reverse at anytime, and we have AMZN and SNAP earnings after the bell. Put sweeps coming through for AMZN, someone's betting on a miss. |

|

|

|

|

|

|

#145 | |

|

Member

|

Quote:

For whatever reason I kept ignoring support/resistance on SPX whenever I would look at levels. For some reason I had it in my mind that SPX is just for Top/Bottom/Key levels, ATR bands, Bollinger Bands, etc......Really don't know why I was thinking that.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

|

#146 | |

|

Member

|

Quote:

Put sweeps? Just a significant amount of Puts coming in? Trying to learn language/terms as well, in addition to just how MM's & Dealers work/use options. Figured factoring this stuff in along with experience will really expand confidence/knowledge of market. Thanks again.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

|

#147 |

|

Member

|

Based on 4125 open.

SPX bottom 4100, Top 4175 (Resistance 4150, C O/I 9k)(break above 4200), Key Level 4130 SPY 412.4 - .7 Puts, above 415 SPY 410.5 - .75 Calls

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#148 | |

|

Member

|

Quote:

You'll see an increase in gamma for daily exposure (positioning changing) - usually the strike above or below a spot price. For example yesterday before the big pump there was a massive exposure increase for 4100 and we moved up to that, then we had a increase in exposure for the 4120/4130 strikes. So based off yesterday I'd expect to see some downside today - doesn't mean it will happen though. Dealers and MM's also lose money too on bad trades/hedges. I just gave a quick simplified summary above, if you want to learn more in-depth about how dealers and MM's use the market, you can read about the greeks. It seems complicated at first, but once you piece it all together it'll make more sense. As for the put sweeps, correct. Some large block orders for puts went through about 4 mins before close. ------------------------------------------------------------------------------ It's Friday, don't give back all the gains from the week. Only A+ setups today. SPX: 4160 top (4150 resistance) / 4070 bottom (break below > 4050 we also have a gap @ 4030.59) / 4100 key level (4130/4140 resistance). Watching: SPY - Still holding the 410-410.3 support. Below there I like bounces at 408.68 and 407.52 (higher probability). Rejects 413.57 & 415 |

|

|

|

|

|

|

#149 | |

|

Member

|

Quote:

Update: Watching SPX as it might be rejecting yesterdays close. Update: blew past yesterday close, would still hold and wait for 4150.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink Last edited by ajlaxmn; 04-28-2023 at 08:47 AM. |

|

|

|

|

|

|

#150 | |

|

Member

|

Quote:

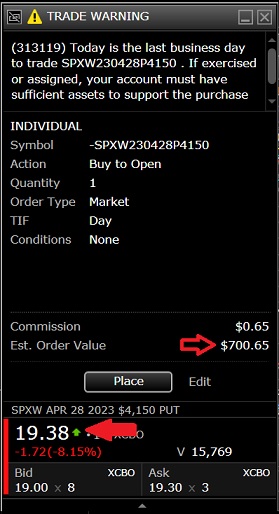

Calling it a day here. The setups worked out perfect this morning. SPX: 4160 top (4150 resistance)✅ - 4150 provided some nice resistance but we finally broke through and hit 4160 which was the implied top today. Rejected as expected for a 25 point move down. Calls went from $700 - $1,900 in about 30 mins. $1,200 gain/contract. Hope everyone enjoys the weekend, and as always, weekends are a good time to learn if this is something you're interested in.

|

|

|

|

|

|

| Bookmarks |

|

|