|

|

|||||||

| Off Topic This section may contain threads that are NSFW. This section is given a bit of leeway on some of the rules and so you may see some mild language and even some risqué images. Please no threads about race, religion, politics, or sexual orientation. Please no self promotion, sign up, or fundraising threads. |

|

|

|

Thread Tools | Display Modes |

|

|

#1451 | |

|

Member

|

Quote:

Gains from GOOG puts and SPX puts $7.6k. GOOG puts went from $560 > $1,150 SPX puts went from $1,200 > $2,600. All out of every thing. No more trades until FOMC. |

|

|

|

|

|

|

#1453 | |

|

Member

|

Quote:

Awesome day today. $21.9k for the day.  Patience is key and I didn't take a trade until my level was hit - held through 4869/4866 because we blew past those levels and became resistance.  Back at it tomorrow. |

|

|

|

|

|

|

#1454 |

|

Member

|

That is a sweet day. Will probably wait next week as well, then will start scheduling 2 1/2 hours off possibly twice a week so that I can focus on trading without distraction from work. Except during OPEX, so if two weeks from now is OPEX I will probably wait that week as well.

Blaze, any suggestion for what might be the best days to take a couple hours off in the morning to trade on non-OPEX weeks? Just curious.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#1455 | |

|

Member

|

Quote:

So I'd say any of those 3 days. |

|

|

|

|

|

|

#1456 |

|

Member

|

That's what I was leaning towards, thought Monday and Friday may be the days with less movement.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#1457 |

|

Member

|

January went by fast, this year will be over before you know it.

Had a nice sell off yesterday and everything was oversold so we got a nice bounce on Futures. It would be a good idea to wait this morning before trading to see what the market decides to do. If we break yesterdays low we have a ways to go down. Data @ 9:45 & 10 and NFP tomorrow. Big earnings after the bell - AAPL META AMZN looking to play AAPL and META if I can get an edge, I'll see where we are during power hour. SPX: Check levels and find the key level for the day. Gaps @ 4916 from yesterday & 4842 is still open from Jan 22nd. By now we should be able to find SPX levels, give it a shot this month and see what you come up with. Key level then find the tradable range for top & bottom levels. Watching: SPY: Watch premarket high's & low's for breaks TSLA: still on watch, we're staying below 190 > if we can break 190 there's room to 207 (check hourly). Let the trades come to you and don't force or chase and watch for confirmations as we approach levels. |

|

|

|

|

|

#1458 | |

|

Member

|

Quote:

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

|

#1459 | |

|

Member

|

Quote:

Correct. Any space in-between there is the "gap". 2 screenshots for visuals.

|

|

|

|

|

|

|

#1460 |

|

Member

|

Not in anything yet, saw the signs of reversal on volume, but didn't want to front run with data at 10, had I taken 4870 P at reject after break below I would have got nice 10 point move, but I got burned on taking a trade ahead of 10 AM data once, so didn't want to repeat, would possibly had taken trade had reversal been more apparent as opposed to right at close of second 15m SPY candle.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#1462 |

|

Member

|

I was in 4870 C based on break above and retest at 10:15, held through being own $400 as I had 4865 as support after being prior resistance. Broke back 4870 but couldn't climb any higher than 4875, was hoping for 4880 so I could exit, but flow is just selling and immediate buying then selling then buying. Was up $250 at one point. Sold for $80 profit.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#1463 | |

|

Member

|

Quote:

We could also get a nice move later in the day after they kill a few premiums then look for liquidity. Based on technicals (not looking at flow or volume) we should hit 4890 area, but might be a slow grind up with some chop. |

|

|

|

|

|

|

#1464 | |

|

Member

|

Quote:

|

|

|

|

|

|

|

#1465 | |

|

Member

|

Quote:

Well, there's the liquidity grab. Took 1 call off the ATR to see what we do here.✅- worked out perfect. Went level to level. Contract went from $1,000 > $1,860 Gains for the day $860  Done for now, back @ power hour. |

|

|

|

|

|

|

#1466 | |

|

Member

|

Quote:

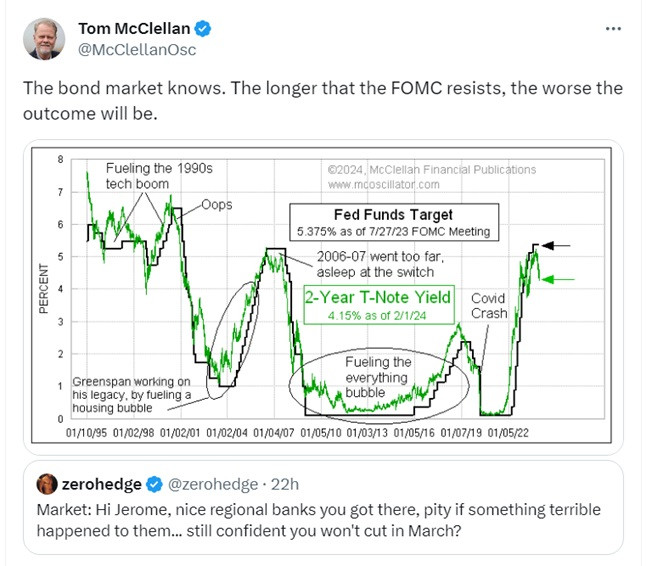

But there you go. 4890 area lol.  Volume - no idea where the huge volume spike came from. I exited at the ATR because buyers were slowing.  -------------------------------  That's crazy, if $10k is the average there's a lot that owe more. $10k+ in CC debt with CC interest rates 20% or higher? The student loan debt is hilarious too. Not sure what people are thinking when they dig these holes. Fun times ahead when it all comes crashing down. |

|

|

|

|

|

|

#1467 | |

|

Member

Join Date: Dec 2010

Location: Michigan

Posts: 10,035

|

Quote:

I reported $12k in CC “debt” in the past month. It’s all paid off. Sure there are people in real debt, but there’s just as many people who use the cards responsibly for every single expense they have. It’s just such a terrible statistic.

__________________

|

|

|

|

|

|

|

#1468 | |

|

Member

|

Quote:

I'd also say some (probably a small %) of the CC debt isn't even from reckless spending, it's because prices have increased so much for every day items they have no other choice but to charge it and are unable to pay it off every month. Not really their fault. Really sad to see people struggling out there. And anyone who believes the inflation numbers we've been told needs to put on their big red nose and floppy shoes. |

|

|

|

|

|

|

#1469 |

|

Member

|

Nonfarm payrolls increased by 353,000 jobs last month

SPX: 4900 key level / 4950 top 4850 bottom - gap still open @ 4916 ---------------------------- Worth noting  There are a ton of statistics and charts out there that would suggest market is dead man walking. P to C levels are insane right now and just the debt statistic alone is concerning but, the market is at ATH and I would be very surprised if anything unusual happens to peoples 401k during an election year. |

|

|

|

|

|

#1470 | |

|

Member

Join Date: Dec 2010

Location: Michigan

Posts: 10,035

|

Quote:

I could be wrong, but I’ve always taken that data as whatever is reported ina given month to the credit bureaus. I don’t know how anyone would distinguish between balances that get paid off and those that accumulate. Guess it depends on the source of the data.

__________________

|

|

|

|

|

|

|

#1471 |

|

Member

Join Date: Jan 2024

Location: Tennessee

Posts: 52

|

yo yo! I dont trade options but do day trade. 6 months consistently profitable trader after a LONG road.

|

|

|

|

|

|

#1472 |

|

Member

|

Data and Fed speakers today.

SPX: watching 4906 & 4930 (watching these because they've been solid S/R last week) - take a shot at finding the other levels (top/bottom) + watch the ATRs. Keep 5000 on watch. Huge resistance wall when we get there, won't happen today. Watching: BABA: adding more BABA equity to my long term account and selling covered puts a year out. Be patient, don't force or rush trades and follow your plan on entries and exits. |

|

|

|

|

|

#1473 | |

|

Member

|

Quote:

|

|

|

|

|

|

|

#1474 |

|

Member

|

Still in SPX puts off the last close reject - trimmed @ 4931 ATR. Seeing of we can get to 4915 ATR > then gap. If not I'll fully exit runners @ break above 4931 ATR.

Also watching for signs of a reversal for call entry. |

|

|

|

|

|

#1475 | |

|

Member

|

Quote:

Gains from trade $8.4k Also added more BABA equity and sold -BABA260116P75. Long term hold, doesn't make sense why BABA is this low other than China's crappy economy. Earnings this week too. Might check back power hour to see where market is. PYPL / DIS earnings coming up this week. |

|

|

|

|

|

| Bookmarks |

|

|