|

|

|||||||

| Off Topic This section may contain threads that are NSFW. This section is given a bit of leeway on some of the rules and so you may see some mild language and even some risquť images. Please no threads about race, religion, politics, or sexual orientation. Please no self promotion, sign up, or fundraising threads. |

|

|

|

Thread Tools | Display Modes |

|

|

#101 | |

|

Member

|

Quote:

Work meeting so couldn't spend time checking. Thank you.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

|

#102 | |

|

Member

|

Quote:

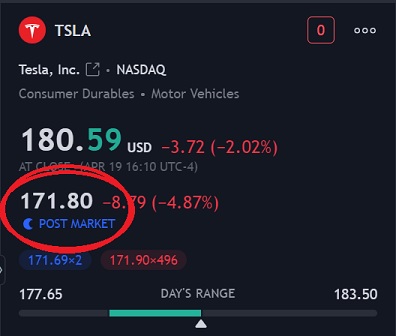

However, I loved seeing that TSLA earnings miss, I added my first TSLA equity add. I'll add more @ $150 then a full add @ $120 I will be adding TSLA equity if it can get down to 170ish✅

|

|

|

|

|

|

|

#103 |

|

Member

|

Is there a reason you are beginning to add now if you believe it will hit $120 eventually?

|

|

|

|

|

|

#104 | |

|

Member

|

Quote:

Buying and holding is nice, but if you got in at say $190-$200 and didn't sell calls against your shares, you're sitting on a nice $20-$30 loss per share. Always make your shares work for you. |

|

|

|

|

|

|

#105 | |

|

Member

|

Quote:

|

|

|

|

|

|

|

#106 |

|

Member

|

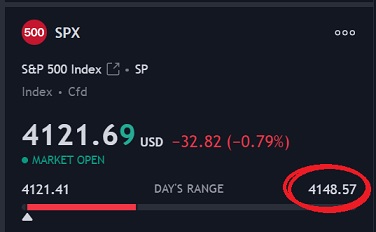

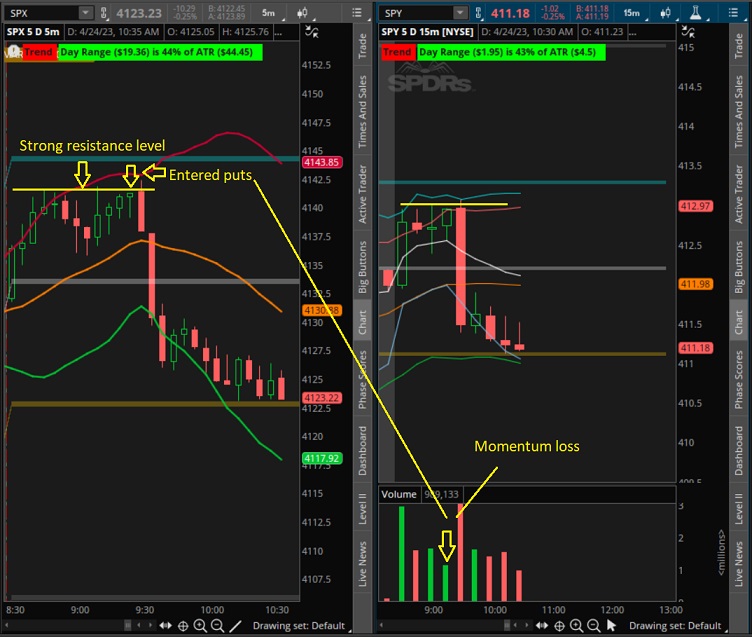

Based on 4123 Open.

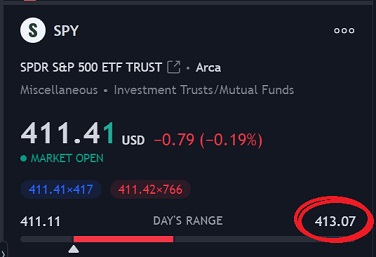

Bottom 4100 (3.8K O/I), Top 4175 (break above 4190), Key Level 4130 (acted as resistance previously, 2.5k O/I) SPY 413 Puts SPY 409.6 Calls

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#107 |

|

Member

|

Trade smart don't force anything

SPX: 4170 top (break above 4180 > 4195 > 4200) / 4100 bottom (break below 4080 next support) / 4130 key level (4150 resistance) Watching: SPY reject 415 for puts SPY bounce 410 for calls TSLA Watching 163.9 for a bounce. Below that, main area is down @ 159.75. Last edited by Blazed; 04-20-2023 at 08:29 AM. |

|

|

|

|

|

#108 |

|

Member

|

If today is antying like the past coule days, their will be a small move in the morning, then it will slowly grind in the opposited direction the remainder of the day. I wonder if we will hang around 4130 most of the day killing Put Theta, then slowly grind up.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#109 | |

|

Member

|

Quote:

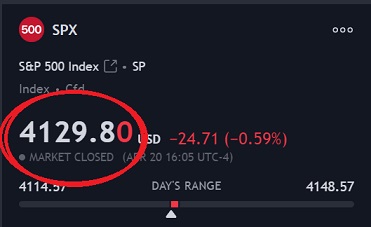

Another range day only good for scalping. I did scalp ajlaxmn's 413 reject level. I completely missed it when checking levels this morning  I was too focused on TSLA. I was too focused on TSLA.TSLA Watching 163.9 for a bounce.✅ - I took the TSLA 165 bounce this morning (close enough, base was built and volume confirmed) bounced a little early but worked out perfect. I sold calls ($200 strike) when TSLA hit $169.50 earlier this morning and will be buying them back when TSLA hits my next price target of $150ish. Still looking for $120 on TSLA. Weekly chart $120 is the super trend, full add when we get there. This will be a long term equity hold and I will continue selling calls/puts against my shares. "Trading is a job where you get paid for your decisions, not your time. You can spend hours in front of a your screen and still make $0." - saw that thought it was pretty cool. Hope everyone enjoys the rest if their day. |

|

|

|

|

|

|

#110 | |

|

Member

|

Quote:

With all due respect I am probably going to add TSLA around the same time you do (real trade), for a long term hold. I think I am then going to papertrade 200 - 300 shares of TSLA to try out selling covered options as I want to explore that, heard of it, but never really thought much of it, but you explaining selling covered calls at highs (assuming covered puts at lows?). I want to see how it plays out.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

|

#111 |

|

Member

Join Date: Aug 2022

Posts: 457

|

Love me some TSLA when it gets pounded like today down 12% and goes on sale

Long term love TESLA |

|

|

|

|

|

#112 | |

|

Member

|

Quote:

A lot of people have 500 or 1000 shares of a stock and they think holding it for that tiny $1,000/year dividend is good but don't think about the other ways they can make their shares work for them. They could be selling covered calls and collecting that premium and collecting the dividend. But this type of stuff is exactly why they don't teach finance in high school they don't want people to understand good debt vs. bad debt and how interest on that debt can screw you. They want people to constantly be saddled with debt from buying stuff they can't afford, because when you're saddled with debt you have to work more or get a second job. The more you work the more taxes you pay. The more taxes you pay the more the government can waste. It's a never ending cycle. /end rant lol. |

|

|

|

|

|

|

#113 | |

|

Member

|

Quote:

And also notice where the closed us. 4th day in a row they've pinned us at the key level - that's the power of OPEX lol. Hopefully we get a bigger range/move tomorrow.  Yessir, that's why this will be a long term hold for me this time. I see TSLA back up into the $500/$600 per share and if this whole "go green" pans out could hit $900/$1000 in a few years. |

|

|

|

|

|

|

#114 |

|

Member

|

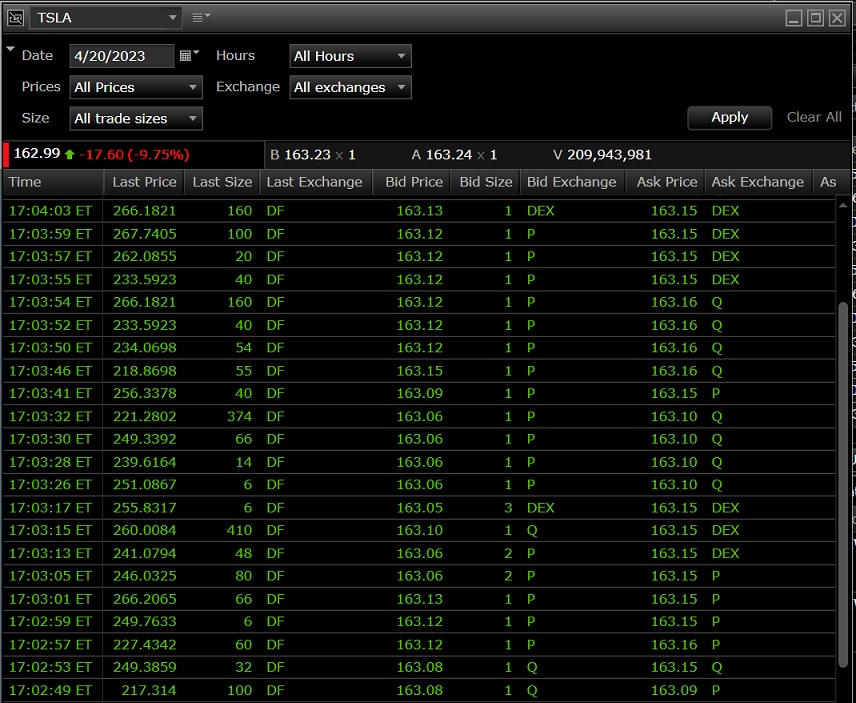

Anybody else catch this? I was looking at TSLA charts and saw some big price spikes. No TSLA isn't trading at these prices. The big players who keep the markets running are sorting out their positions. They are often agreed on in advance so they happen outside of normal hours so it doesn’t disrupt everyone’s systems and look like there's a rally happening. It's always interesting to see this stuff.

|

|

|

|

|

|

#115 | |

|

Member

|

Quote:

Thatís wild. Itís definitely interesting seeing how the big boys can manipulate and move the markets. I canít imagine the amount of people that possibly day trade options that arenít aware of this, that would definitely have been myself if it wasnít for the information you provided, and try to trade calls and puts routinely on weeks like this week and just get smoked with Theta decay. Sent from my iPhone using Tapatalk

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

|

#116 |

|

Member

|

Based on 4130 open.

Bottom 4100 (8k Puts O/I), Top 4200 (13K O/I, I realize maybe this could be 4190, either that or 4190 is resistance, Key level 4150. SPY Puts 413.5, break above 415 SPY Calls 410.3 Blazed, with the market Puts heavy, would you expect Calls to be the play? Seems like their is a lot of O/I for Calls, you think MM keep us choppy to kill Calls Theta then move heavy at end of day upwards?

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#118 | |

|

Member

|

Quote:

I really wanted 4200 last week as that was going to be my short entry but we didn't get it. We could get it this week, but if the market wants to go up MSFT GOOG and META need to deliver good earnings. So next week will be a very fun week. My bias for GOOG is short for earnings. GOOG has room to 107.7 and should get a nice reject there before earnings. My top watches are AMZN MSFT META GOOGL UPS CAT. I'll also be watching credit card earnings, the outlook on there will give an idea of how many people are tapped out and slowing down their spending. |

|

|

|

|

|

|

#119 |

|

Member

|

Based on a 4134 open.

SPX Bottom 4100 (break below 4080), Top 4195 (break past 4180 and we get to 4195), Key Level 4150 SPY Puts 413.5 SPY Calls 410.3 - .5

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#120 |

|

Member

|

Big earnings week - GOOGL, MSFT, META and AMZN - will these be the catalysts for the next move or we will move sideways into next week's FOMC meeting? It's only Monday, see how the market moves and don't force anything. Let the trades come to you.

Levels unchanged from Friday. SPX: 4170 top (break above 4180 > 4195 > 4200) / 4100 bottom (break below 4080 next support) / 4130 key level (4150 resistance) Watching: SPY reject 413.8 for puts SPY bounce 410 for calls TSLA - since I'm getting a few questions on TSLA - the price target for my next equity add is 145 (this level can be found on the daily chart) and I will add full position @ 120 - 122 (this level can be found on the weekly) if we can get down there. Weekends/evenings are a good time to be looking at and learning charts. |

|

|

|

|

|

#121 | |

|

Member

|

Quote:

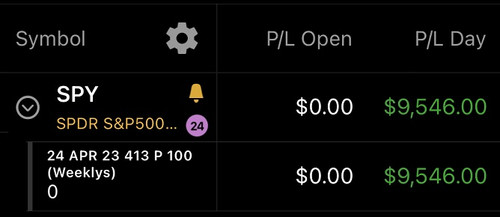

I took the 413 reject. SPX was clearly having trouble @ 4141 and rejected off it 5 times so on the 6th reject I took puts. SPY reject 413.8 for puts✅- The gains on this trade were luck. It looked like we were going to range again for small moves up and down. So I took SPY instead of SPX so I could load up on contracts (150 contracts) since I was only expecting a small move for a scalp. Well the small move turned into a sell off, so I trimmed on the way down, definitely wasn't expecting that big of a move.   Education:

|

|

|

|

|

|

|

#122 | |

|

Member

|

Quote:

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

|

#123 | |

|

Member

|

Quote:

I see we're right back where we opened at and have been around this area all day. Lets see what power hour does, might get a bigger move the last 10 mins today during algo time. |

|

|

|

|

|

|

#124 | |

|

Member

|

Quote:

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

|

#125 |

|

Member

|

SPX: 4170 top / 4100 bottom (break below 4080) / 4130 key level ( 4140 resistance)

Watching: SPY watching both ways - 410 is holding SPY up. Iím looking to fail 410 and retest for puts entry. Will also look for a bounce at 410 - we have bounced this area multiple times which could be making it weaker. SPY reject 412.8 area for puts SPY bounce 407 for calls TSLA looking weak |

|

|

|

|

| Bookmarks |

|

|