|

|

|||||||

| Off Topic This section may contain threads that are NSFW. This section is given a bit of leeway on some of the rules and so you may see some mild language and even some risqué images. Please no threads about race, religion, politics, or sexual orientation. Please no self promotion, sign up, or fundraising threads. |

|

|

|

Thread Tools | Display Modes |

|

|

#51 |

|

Member

|

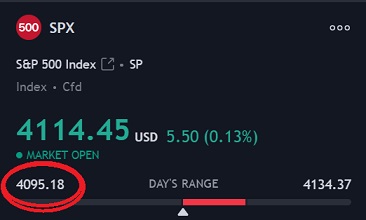

Took SPX 4070 Calls when we rejected ATR band at 4071, SPY was bouncing lower BB at the time and had bounced lower BB over the long weekend. first SPY 15m candle confirmed volume of buyers. Sold for $150 profit when SPY BB was curving down, and volume of 15m candle, which was green, was lower than the previous red candle. Also, seems that SPY is rejecting 406 this morning initially. Nothing major, but its something and its practice.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink Last edited by ajlaxmn; 04-10-2023 at 09:32 AM. |

|

|

|

|

|

#52 | |

|

Member

|

Quote:

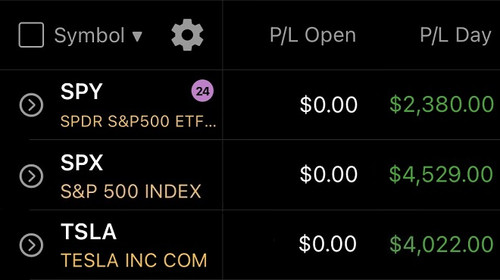

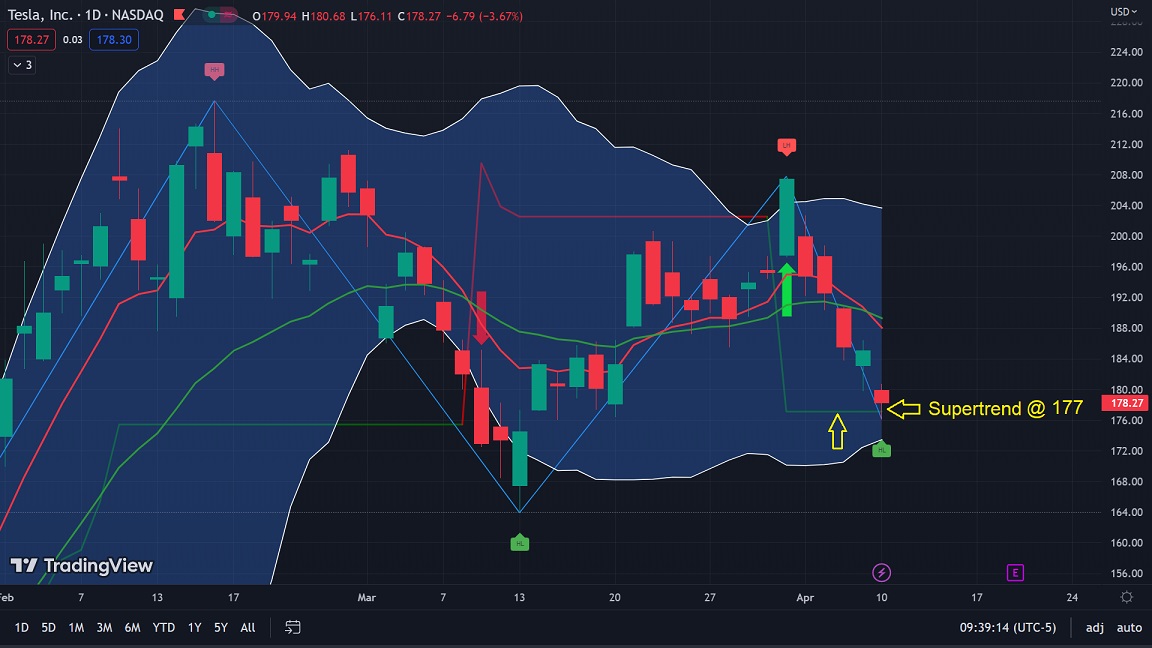

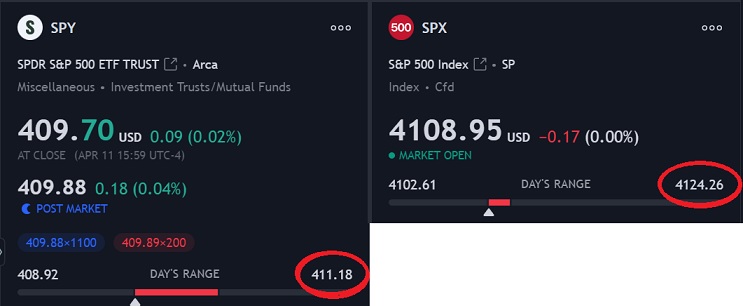

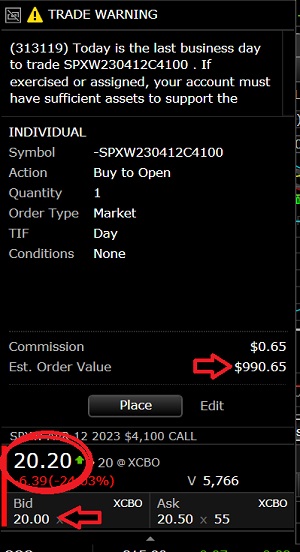

Great start to the week so I will be calling it a day here. TSLA SPY & SPX hit today. SPY bounce 406 area✅- nailed it TSLA is on track to hit my first price target of 177✅- nailed this one too. I was hoping it would dip down to 175, but I still have a price target of 120ish for TSLA.   Education: TSLA target price - the 177 bounce was off the daily supertrend. Easy easy play to see coming once TSLA broke below the 8 & 21 EMA's. That is why it's important to look at charts before entering trades - even equity - as you want to get a good fill. Until TSLA hits my price target for adding equity, I'll play puts. SPY 406 bounce was the same level from last week. It was a strong support and we didn't break it premarket, so you test calls at support. Support is support until it's not, same with resistance. If SPY gets back up there 410 is strong resistance followed by 411.5. Knowing how to read charts is what gives you confidence to take trades. It doesn't matter if its a long trade (week/month), or a day trade - the technicals will play out the same way. Hope everyone enjoys the rest of their day.

|

|

|

|

|

|

|

#53 | ||

|

Member

|

Quote:

Quote:

We still have a gap on SPX @ 4030.59 back from 3/30 & 4127.66 from 4/4 - I leave these on my charts until they get filled. |

||

|

|

|

|

|

#55 | |

|

Member

|

Quote:

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

|

#56 |

|

Member

|

CPI & FOMC Minutes tomorrow. Fed Williams said - "if inflation comes down Fed will need to lower rates".

SPX: 4130 top (break above 4150 next resistance) / 4050 bottom (break below 4030 next support) / 4100 key level SPX - 4100 key level again. To see any type of move up we need to break 4117 > 4130. Watching: SPY reject 411.5 - strong level from last week. We need to break it to see a move up - main reject on SPY after 411.5 is 414. SPY bounce 408. Key area is 406. |

|

|

|

|

|

#57 | |

|

Member

|

Quote:

Yeah, I do this pretty often - leave a lot of money on the table - so sometimes I leave runners to catch that extra move if I see the trend is still intact. If I'm deep in profits and can't monitor my position, I'll set a hard stop just above break even in case it reverses on me. If I'm not deep in profit and can't monitor, I just exit the whole position. |

|

|

|

|

|

|

#58 |

|

Member

|

Had a meeting at 9 so couldn't post in time. I meant to post for what I thought the range was based no a 4113 open at 8:45.

Bottom 4050, Top 4150, Key level 4100. Also realize bottom could be 4060 and top could be 4140. Wanted to post a screen shot so I could show what I was seeing, but not able to right now.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#59 | |

|

Member

|

Quote:

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

|

#61 | |

|

Member

|

Quote:

|

|

|

|

|

|

|

#62 | |

|

Member

|

Quote:

So I assume that SPX was at 4130 the last time SPY rejected 411.5? Definitely learning something new on that. That would be typical then? If SPY has a reject that has held for what, multiple days in a row, multiple times? Then SPX top and I would assume bottom in the case of support will be dictated by that?

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

|

#63 | |

|

Member

|

Quote:

|

|

|

|

|

|

|

#64 |

|

Member

|

CPI (Mar YoY) 5% vs 5.1% Expected; Ex-food and Energy 5.6% vs 5.6%. We all know it's a bs number, but take what the market gives.

My opinion - the market will dump but first they need to kill massive short positions, this market is so speculatively short that its set up massive amounts of liquidity to hunt. SPX: 4180 top (break above 4200 next resistance) / 4100 bottom (break below, 4090-4080 next support) / 4130 key level Watching: SPY: 413.75-414 is one of my main rejects. Others are 415 then 418.5 (highest probability). Bounce @ 411-410.5 |

|

|

|

|

|

#65 |

|

Member

|

Bottom 4050, Top 4150, Key Level 4100.

Edit: Totally Wrong I rushed it as work was getting in the way.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink Last edited by ajlaxmn; 04-12-2023 at 08:30 AM. Reason: Totally Wrong |

|

|

|

|

|

#66 | |

|

Member

|

Quote:

All done for the day - at least until FOMC minutes. Both the bounce and reject worked out. SPX: 4130 key level.✅ - grabbed puts at the break below 4130 and cut them @ my SPY bounce level Bounce @ 411-410.5✅ - grabbed calls @ 410.5 and rode them back up to the 4130 SPX reject. That is how you play support and resistance levels.

Last edited by Blazed; 04-12-2023 at 09:24 AM. |

|

|

|

|

|

|

#67 |

|

Member

|

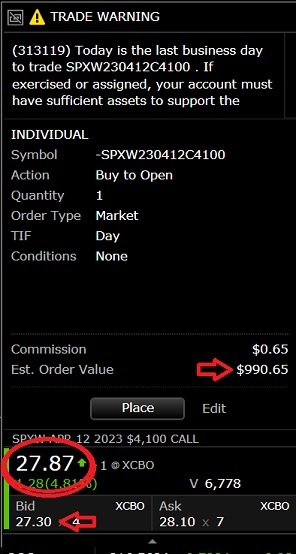

Took SPX 4130 calls, was not paying attention, 4130 was key level and it rejected, and then rejected it multiple times for confirmation. I rushed everything this morning. Live and learn.

Edit: Took a second trade, 4110 puts when SPX broke previous close and SPY showed volume, held until SPY bounced 408.3-408.5 area which had show support prior. $670 profit, much better second trade in terms of entry exit then first trade.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink Last edited by ajlaxmn; 04-12-2023 at 10:28 AM. |

|

|

|

|

|

#68 | |

|

Member

|

Quote:

If you took the 4100c your up $1,000/contract - times 5 contracts = $5,000 gain. Doesn't get much easier than that. You simply wait for a level to hit and you execute.   ------------------------------------------------------------------------------------------------- Edited to add: I'm all out @ $2,750/contract - times 5 contracts = $8,800 gain by simply waiting for my level to hit and took 5 contracts. I exited @ the 4130 reject level and we rejected there as expected.

Last edited by Blazed; 04-12-2023 at 09:33 PM. |

|

|

|

|

|

|

#69 |

|

Member

|

Bottom 4100, Top 4190 (weak resistance at 4175), Key Level 4150

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#70 |

|

Member

|

Initial Jobless claims came in higher and PPI came in lower, that's why we saw the move up - again, we all know it's bs numbers so lets see how this plays out today. I'd like to see a pump at open then drop like yesterday.

SPX: 4130 top (break above 4150 next resistance) / 4050 bottom (break below, 4030.59 (GAP) next support) / 4100 key level Watching: SPY - Rejects @ 410.4 and 411.5 (higher probability). Bounce 405 - 404.5. |

|

|

|

|

|

#71 | |

|

Member

|

Quote:

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

|

#72 |

|

Member

|

I didn't take the paper trade, on TOS mobile again, but would have taken SPX 4100 C on the open as it rejected, and has rejected multiple times. Would have based closing position out off from Blazes 410.4 and 411.5 SPY reject.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#73 | ||

|

Member

|

Quote:

Quote:

Could be setting up for a trend day (we're pushing up right now on low volume so we could see a reversal around lunch time - we'll see), but we still have to break 4130 SPX & 411.5 SPY if we are going to see any higher highs. |

||

|

|

|

|

|

#74 | |

|

Member

|

Quote:

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

|

#75 | |

|

Member

|

Quote:

You've also posted that you've rushed it a couple of times. The days you didn't rush it you were hitting the levels (including SPY support/rejects), so maybe that contributed to the off days? Also, you haven't been doing this too long so there's a learning curve to the "tougher" days like the past few. So for the amount of time you've been doing this, you're doing great but it will take time to perfect it - and no matter how good you get, there will be off days. I have them too, where I miss a level or forget about a strong level because I didn't mark it. So it's all good man, just keep learning as much as you can and make sure you journal what made you select the wrong levels; i.e. checked too early, rushed, TOS mobile app sucks and you need to use a chart... Don't get discouraged, you'll get there in time. |

|

|

|

|

|

| Bookmarks |

|

|