|

|

|||||||

| Off Topic This section may contain threads that are NSFW. This section is given a bit of leeway on some of the rules and so you may see some mild language and even some risqué images. Please no threads about race, religion, politics, or sexual orientation. Please no self promotion, sign up, or fundraising threads. |

|

|

|

Thread Tools | Display Modes |

|

|

#376 |

|

Member

|

Keep an eye on VIX, it's at 14 - it should explode soon. Trade smart, be patient and don't trade in between levels or force anything. Let the trades come to you.

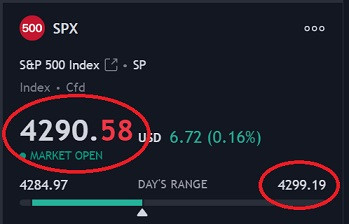

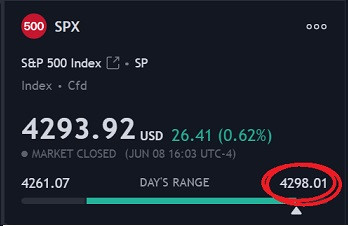

SPX: 4320 top / 4290 key level (break above > 4300) / 4260 bottom (break below > 4250) Watching: SPY - Main reject 429.61 - 430. Above there has room to 431.73. Only bounces I see are 426.5 (higher risk) & 423 (Higher probability) TSLA - Has some relative strength in the premarket. If the market gets strong and TSLA breaks 228.9, I'll look for it to push into 232.82 for a potential reject. Bounce 225 (high risk). |

|

|

|

|

|

#377 |

|

Member

|

Not going to post levels today as I am using ToS online and I have no interest in screwing around with that junk today. Will watch Blazes level's and see what comes to fruition.

In 4290 calls were i paper trading as it blew right past it. Something else might prove to be wrong, but jsut using ToS mobile, i would be in.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink Last edited by ajlaxmn; 06-07-2023 at 08:34 AM. |

|

|

|

|

|

#378 | |

|

Member

|

Quote:

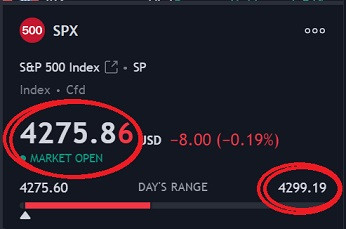

There's your one good trade if you caught it. SPX: 4290 key level (break above > 4300)✅ SPY - Main reject 429.61✅ - 🎯 direct hit.

|

|

|

|

|

|

|

#379 |

|

Member

|

All out here for a $13.5k day.

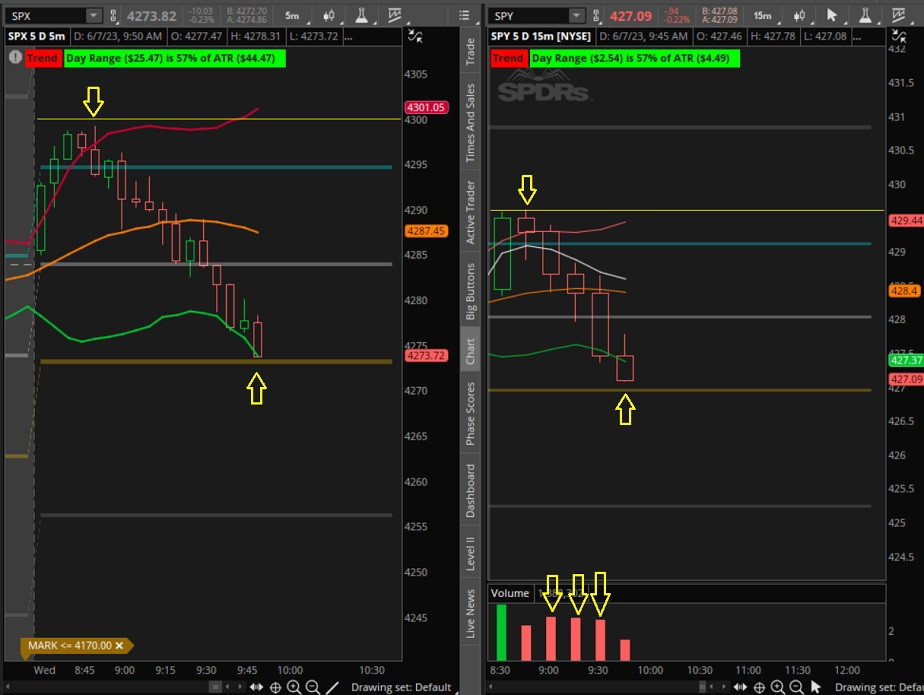

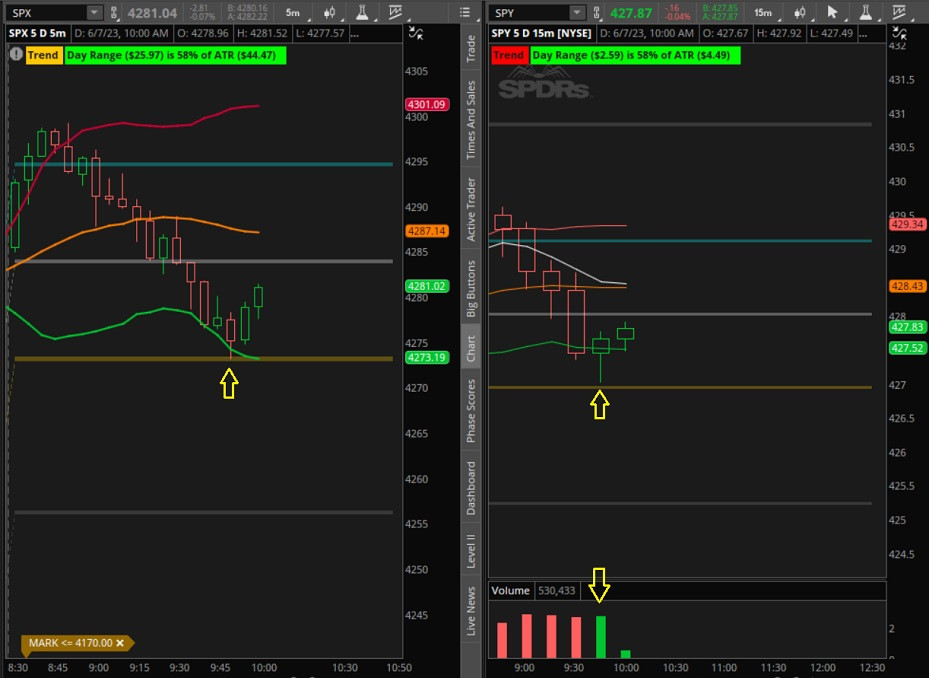

If you followed volume you'd know the downtrend was going to continue. Top ticked the put entry at 4300. There's no reason you should have had a red day if you entered when the level hit. Easiest way to trade is to let the trades come to you. As I've said many times before, and it's worth repeating, trading options isn't hard if you know what you're doing. Hope everyone enjoys the rest of their day!    Bounced off the ATR band (confluence SPY/SPX again) and we're headed up.

|

|

|

|

|

|

#380 |

|

Member

|

As always, wait for an opportunity to present itself. No opportunity, no trades. Opportunity ='s A++ setups. A++ set ups are @ the level/ATR bands.

SPX: 4300 top (break above > 4310) / 4275 key level (break above > 4280 > 4290) / 4250 bottom (break below > 4240) Watching: SPY - Rejects at 427.68 & 428.14. The only bounce I like so far is @ 423.25 - 422.95 NVDA NVDA - puts under 375.5. Gap fill play is my top watch today/rest of the week. if we crack yesterday's low of day, we have room to fill the gap down to 320. |

|

|

|

|

|

#381 |

|

Member

|

|

|

|

|

|

|

#382 | ||

|

Member

|

Quote:

TSLA 245 AH. Should see 250 soon. If we can break above 250 > 258.6 is next. If we reject here back to 233.7. Technicals don't lie =  Quote:

SPX: 4300 top✅ SPX Key level: 4275 (break above > 4280 > 4290)✅  ` `

|

||

|

|

|

|

|

#383 |

|

Member

|

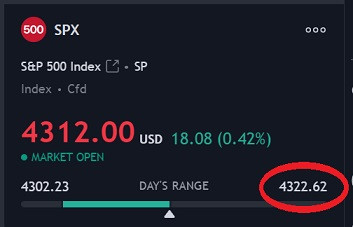

It's Friday, take what the market gives. Looks like we have a good set up to the upside. Need to break and hold 4300 on SPX (429.6 on SPY) to continue up.

Be patient, trade smart and end the week good. SPX: 4330 top (4310 > 4320 resistance) / 4300 key level / 4250 bottom (4275 > 4260 support) Watching: SPY - 429.61 is still my key area. Will look for a break & retest of the area. If price rejects I like puts. Will be watching intraday for good setups. 4300 is key on SPX. TSLA - gapped up massive. Expect profit taking and a further push up. Watching for a pull back to 245 for entry for calls |

|

|

|

|

|

#384 |

|

Member

|

Back at it today. "Don't give all your gains away" - Uncle Blazed

Top 4350 (4325 resistance), Bottom 4250 (Support 4285 break through 4275), Key Level 4300 SPY 429.1-.4 for Calls SPY 431.3 for Puts

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#385 | |

|

Member

|

Quote:

Boom. One good trade. TSLA: Watching for a pull back to 245 for entry for calls✅  --------------------------------------------------------------------------- Added: Up $700/contract X 10 cons.

Last edited by Blazed; 06-09-2023 at 08:55 AM. |

|

|

|

|

|

|

#386 |

|

Member

|

I entered 4300 as well, exited when I got to $500 profit, really want to get this down so that I have the same mindset when i switch to real money. exited at about 4312. Still should have stayed in though to about 4320-25, which is a level I had.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#387 | |

|

Member

|

Quote:

431.3/4315 reject? Confluence? Or is too much SPY volume there?

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

|

#388 |

|

Member

|

Nice trade! $500 while learning/just starting out is great. I stay in sometimes longer as long as volume confirms and I don't see any momentum loss. I want that 4320 area though today - big area.

|

|

|

|

|

|

#389 |

|

Member

|

Missed that 4320 was ATR band.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#390 |

|

Member

|

|

|

|

|

|

|

#391 |

|

Member

|

Yeah, that's why I got out

Next ATR @ 4328 so we'll see if it gets there. Next ATR @ 4328 so we'll see if it gets there.------------------------------------------------- Anyone watching for puts, be patient buys still strong. Don't force or rush things. Market just opened 45 mins ago. |

|

|

|

|

|

#392 |

|

Member

|

Does anyone use Fidelity for charting? Are you using Active Trader Pro and is it free? I clicked on my trading dashboard and got the following:

Based on our records, you're currently designated as a professional quote user* and must be enrolled in Streaming Real-Time Quotes at $123.50/month in order to maintain access to the Fidelity.com Trading Dashboard®. Just trying to figure out if the Dashboard and Active trader are different. No way am I dropping $124/mo. Or maybe neither are free for me due to being a professional?

__________________

checkoutmycards.com/users/0023 |

|

|

|

|

|

#393 | |

|

Member

|

Quote:

waiting for put entry 4320-4322.✅  ---------------------------------------------------------------- Added 10:29a All out of puts here. Back at support. $23.4k total for the day.

Last edited by Blazed; 06-09-2023 at 10:32 AM. |

|

|

|

|

|

|

#394 | |

|

Member

|

Quote:

I chart on Think or Swim/trading view. Both free. Fidelity charts are garbage imo. But try it out, you might like it. Oh yeah, and if you use Fidelity use the Active trader pro app. The dashboard on the website will only frustrate you. |

|

|

|

|

|

|

#395 | |

|

Member

|

Quote:

__________________

checkoutmycards.com/users/0023 Last edited by swerve; 06-09-2023 at 09:53 AM. |

|

|

|

|

|

|

#396 |

|

Member

|

|

|

|

|

|

|

#397 | |

|

Member

|

Quote:

I was looking at the SPY candles and the second was lower than the first and the third appeared to be closing lower than the second, all three green, so I thought volume was slowing, was this an incorrect assessment? Appears it was when I entered.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

|

#398 | |

|

Member

|

Quote:

No candles on SPX or SPY closed above resistance. That's key to holding your position. Once they close above, resistance can turn support then you'd cut and look for re-entry.   Not sure where you entered (4220? 21?). I entered puts @ 4321.5 and took some draw down too - the only way I would have cut was if we broke above 4322 with volume and the candle closed above 4322. No candles closed above so no reason to cut as we were still below strong resistance. I bolded it because I follow this rule on every trade I'm in. You want to see the candle close above - that's key for resistance levels. If candles don't close above resistance (or close below support if I'm in calls) then I stay in my position. Always. This rule is why I'm able to stay in trades and accept the drawdown without panicking or selling at a loss. Remember also, SPY/SPX were hitting strong resistance at the same time, you called it in your other post (confluence) but had 4315? instead of 4322. So while you exited and missed the move, maybe go back and replay the trade (forget what they call it on TOS - instant reply or something like that) to see how it played out again. Watch the candle right before the first red one on SPY. Mostly selling volume and the candle flipped green about 2 mins before it closed. Corrected typo - I meant selling volume not buying. Last edited by Blazed; 06-09-2023 at 12:51 PM. |

|

|

|

|

|

|

#399 | |

|

Member

|

Quote:

Will do. Thanks. Good note on the closing above or below support/resistance, didn't really consider that, more just looked at it as if the position was getting moved a couple points past the level, then I cut. Good to note.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

|

#400 |

|

Member

|

This run we are on is crazy to me. How much longer could it go? I wouldnt have expected we would be this close to the Covid peak already. If SPY breaks $431.87 on the Weekly, the next major resistance isnt until $450.

I am just standing by and may even look into puts a little ways down the road depending on this 431 break. |

|

|

|

|

| Bookmarks |

|

|