|

|

|||||||

| Off Topic This section may contain threads that are NSFW. This section is given a bit of leeway on some of the rules and so you may see some mild language and even some risqué images. Please no threads about race, religion, politics, or sexual orientation. Please no self promotion, sign up, or fundraising threads. |

|

|

|

Thread Tools | Display Modes |

|

|

#302 | ||

|

Member

|

Quote:

Were you trying to bounce 411.3? I saw that level too but selling was super strong when we got near it. Quote:

You're doing great so far man. You paid a little tuition back to the market today and you learned from it. That's what will make you a good trader in the long run. You're doing great so far man. You paid a little tuition back to the market today and you learned from it. That's what will make you a good trader in the long run.

|

||

|

|

|

|

|

#303 | |

|

Member

|

Quote:

Thanks man, I really want to get this. Today was an example of what happens when I don’t stick to my plan. Back at it tomorrow!

|

|

|

|

|

|

|

#304 | |

|

Member

|

Quote:

McCarthy screwed up the trade yesterday no doubt. But confidence and conviction is a big key in this game. Today is a new day, whatever happened yesterday is forgotten (I know easier said than done). I took an $8k loss a week or so ago by taking a totally dumb trade that I knew better than to take, but the next day was a new day. Buy you're doing great so far, keeping the losses small and learning from each trade, just takes a little time. You'll always be learning too, that's why I was hoping more people would start participating in the thread because I've learned a few new things from people on here too. If you like to read, "Trading in the Zone" by Mark Douglas will help with understanding yourself better and get you in the right mentality as well as having full confidence when trading. I had the same problem early on, I'd watch levels hit and not take the trade then watch it go the way I wanted it to. Changing my mindset really helped with that. |

|

|

|

|

|

|

#305 | |

|

Member

|

Quote:

----- Downside to having to do my real job. Missed us hitting 410... Not much time before Fed now though.

__________________

checkoutmycards.com/users/0023 |

|

|

|

|

|

|

#306 | |

|

Member

|

Quote:

I got the 410.3 - 410 level from May 16th on the 4 hour. If this helps anyone - I've starting going to the higher time frames for SPY because I've been noticing those levels tend to give a higher probability for a bounce/reject. I switched when the market started getting choppy the first 15-45 mins over the last few months. So I zoomed out on time frames. Premarket levels still work, just have to watch them closer and they tend to be better for scalps. Just an idea, but as always, trust what you see and trust your own levels. Use what works best for you. FOMC in 45 mins. |

|

|

|

|

|

|

#307 |

|

Member

|

I didn't play NVDA earnings, but if you did congrats. Up $60.

Minutes recap: It was a higher risk trade but the R/R was there to take it. I grabbed some 4110 calls when we were holding 4107 (410.2 on SPY) real good and selling volume slowed down. Patiently waited for a pullback to 4107 support and took some calls Took a while, but contracts finally exploded from $430 > $1830 for a gain of $1400 per con. Back at it tomorrow.

|

|

|

|

|

|

#308 |

|

Member

|

ToS online still not showing me O/I. Really curious as to what is going on. This sucks for levels.

Based on 4154 Open. Now have a gap up at 4185, and a gap down at 4150 (depending on actual open). Bottom 4100 (4130 Support), Top 4200 (4180 Resistance), Key Level 4150 SPY Puts 416.2, high probability both 1hr and 4hr timeframe SPY Calls 414

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#309 |

|

Member

|

I'll be looking for calls off the open. SPX will push up off the NVDA pump until buyers get tired. QQQ will pump along with NVDA if you like trading it.

SPX: 4200 top (break above 4210) / 4150 key level (break above 4170 resistance) (break below 4130/4125 > 4110 support) / 4100 bottom. 5/24/23 gaps @ 4132.96 / 4142.54 Watching: SPY - Bounce at 410 - 410.3. Rejects 416.35 - 416.7 |

|

|

|

|

|

#310 |

|

Member

|

late entry into 4145 puts, should have been 4150 puts as soon as it broke through, but checked O/I immediately after open and say 5k O/I on 4145 Calls. Should have been immediate 4150 Put entry, need to start having certain contracts loaded for preparation off the open like this. We'll see how 4145 holds, big gap down, but as Blazed said, NVDA earnings, just don't know who much SPX moves off NVDA.

Stupid ToS Online, man I hate this, I will never use the online to do actual trades. Thought I had submitted for 4145 Puts, didnt' change to market price and left at limit so the trade was still sitting waiting for the limit price. Don't care, win in my eyes, I did hesitate initially on 4150 Puts, but I was under the impression I was in 4145 puts and preparing to sell when it got done to 4132, more for a $500 gain, which will be my limit when I do actual trades. Not going to chase around.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink Last edited by ajlaxmn; 05-25-2023 at 08:46 AM. |

|

|

|

|

|

#311 |

|

Member

|

Had the same thought of puts off the open but had to step away from my desk and missed it. Right now I think I am looking for below 412.50 on SPY to take calls.

__________________

checkoutmycards.com/users/0023 |

|

|

|

|

|

#314 |

|

Member

|

Do what I am doing, commit yourself to not taking a trade for another 6-8 months so you have all that time to get screen time. Go back and just read through this thread, starting on page 1. Definitely read Trading in the zone. Keep posting levels on here like Blaze and me (which I am not always right), post what you did and what you looked at why you think it worked and why it didn't, the more little things you do that are committed to this the more it will become engrained in your routine and start to build your confidence, knowledge, and understanding.

You'll be fine man.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#315 | |

|

Member

|

Quote:

|

|

|

|

|

|

|

#316 |

|

Member

|

Are you making trades just for the sake of making a trade that day? Blaze has preached patience. One of my failed trades was impatience, lesson learned.

Work got in the way of me taking 412/412.50 calls I was looking for earlier. Not going to chase, if I don't get any other set-ups today, it is what it is.

__________________

checkoutmycards.com/users/0023 |

|

|

|

|

|

#317 |

|

Member

|

Nice little 4130 bounce.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#318 | ||

|

Member

|

Quote:

Quote:

P + P = P Plan + Patience = Profits

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

||

|

|

|

|

|

#319 | |

|

Member

|

Quote:

Unfortunate, but I also need to work on my mental. |

|

|

|

|

|

|

#320 | |

|

Member

|

Quote:

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

|

#321 | |

|

Member

|

Quote:

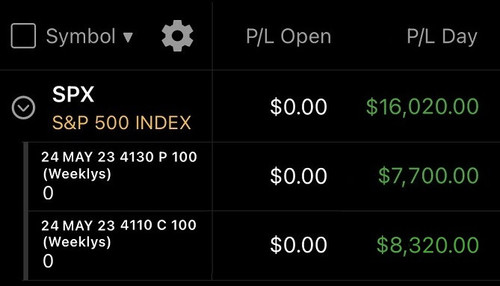

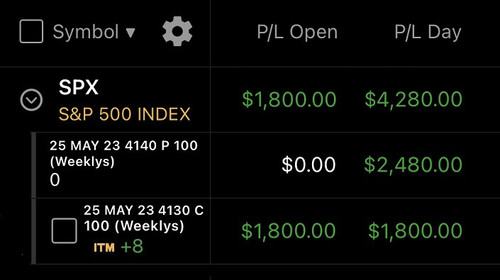

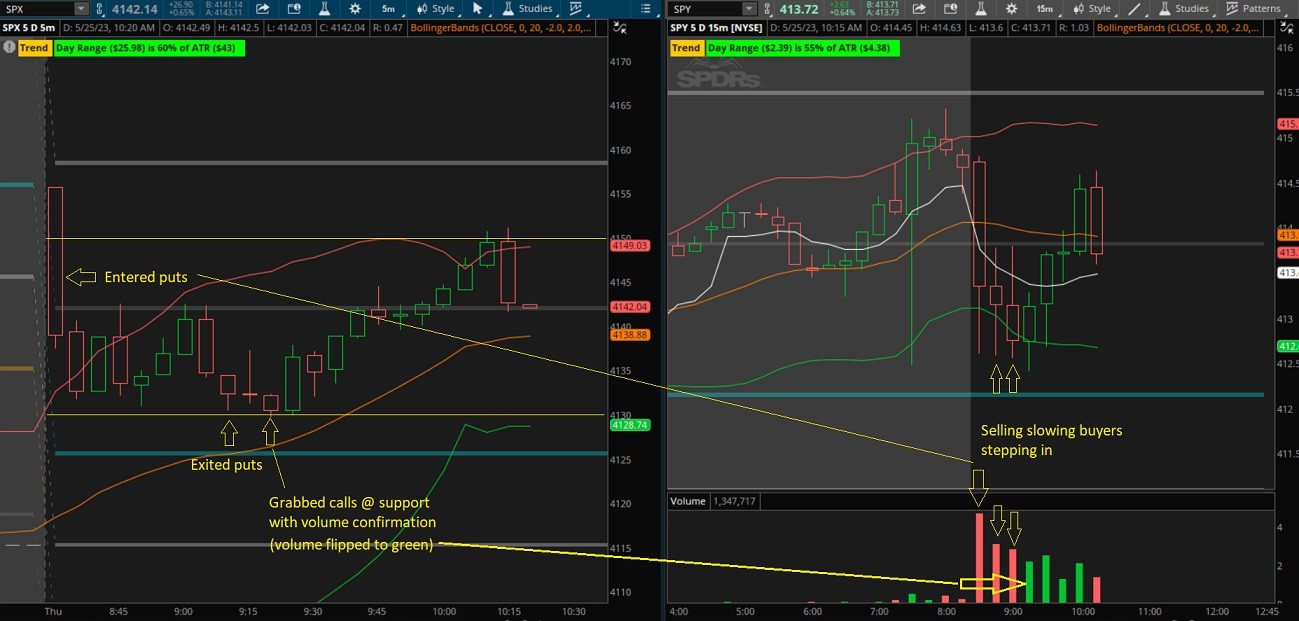

Trade recap: Calling it a day here. I'll be looking for calls off the open.❌ - went into the day with bias. I was expecting a pull back off the open to get into calls, but not that big of a pull back. So when I saw strong selling volume coming in I grabbed some puts (basically chased because I wasn't really looking for puts). SPX: 4150 key level✅- at the break below with volume I grabbed some puts. SPX 4130 support✅- took calls here and I will let this position run for a while. I'm ITM and in profits so I set my hard stop in profits - I'll get stopped out at +$800.   Education: What I saw and was watching  ----------------------- Added: I got stopped out of calls while making the post Last edited by Blazed; 05-25-2023 at 10:40 AM. |

|

|

|

|

|

|

#322 | ||||||

|

Member

|

Quote:

Nice trade! And this is exactly why I do market orders. I've never tried trading off TOS website, but I've never heard not even one good thing about it. (side note for anyone new or anyone that's never done market orders - you can get royally screwed on market orders if you chase a position on SPX due to how fast it moves. So if you miss an entry on SPX let it go or do a limit order.) Quote:

This 100%. Quote:

Trading off the open is hard with the current volatility, even for me some times. Sometimes I don't even take a trade until 30-40mins after open and things settle down - as they say, "paytience" pays. Quote:

Exactly this. Patience + A+ setups = win. Quote:

The bolded is exactly right. If you're patient and wait for a level to hit (you should be watching for other confirmation as that level is approached) and if you see confirmations you enter without even thinking about it. That's part of the "mental" part of the trading game. Doesn't matter if you're right or wrong, you followed your plan and you know you took the trade for a reason. Take an L? Go back and see what you could have done different or missed and learn from it. Hesitation and over thinking is what causes most traders to take losses. Remember, you're trading against algos and HFT's, they don't think or hesitate, they trade levels and flow. Quote:

|

||||||

|

|

|

|

|

#323 | |

|

Member

|

Quote:

Both rejected just a little early, but these farther out trades are the higher probability trades that happen after the morning volatility settles down and we get a direction. SPX - 4150 Rejects 416.35 - 416.7key level (break above 4170)✅ - calls at the break above and puts at resistance SPY - Rejects 416.35 - 416.7✅ Day trading is simple. The challenging part is mastering your mindset. Make trading stress free and wait for the setups to come to you.

|

|

|

|

|

|

|

#325 |

|

Member

|

Once again Option O/I not showing. I'm on the desktop App now, I got to figure this out.

Based on 4160 Open. Bottom 4100 (4130 Support, bounced it yesterday), Top 4200 (4180 resistance), Key Level 4150. Gap at 4130. SPY 416.2 - .3 for Puts SPY 414.2 - .6 for Calls

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

| Bookmarks |

|

|