|

|

|||||||

| Off Topic This section may contain threads that are NSFW. This section is given a bit of leeway on some of the rules and so you may see some mild language and even some risqué images. Please no threads about race, religion, politics, or sexual orientation. Please no self promotion, sign up, or fundraising threads. |

|

|

|

Thread Tools | Display Modes |

|

|

#3101 | |

|

Member

|

Quote:

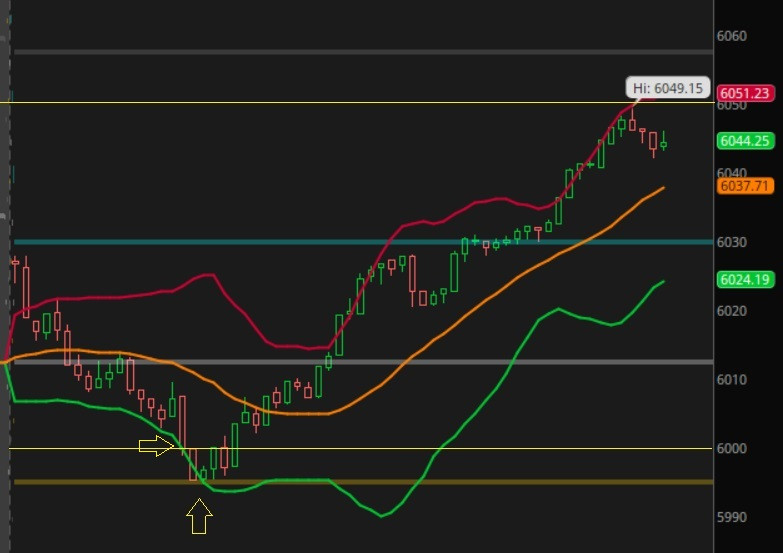

6055/60 & 6110/15 with HIGH O/I Gap at 6051.51.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

|

#3102 |

|

Member

Join Date: Jul 2011

Posts: 1,759

|

Little to no movement based on data premarket. Will probably give it another hour or so to see if we get to 6100 or 6070, at least. A little bit of unclear signals, low volume, and tight range. Buyers slowing on the first two candles, but didn't quite touch the ATR (would have indicated to get in puts generally, and I suppose there was a little bit of a selloff relative to today's movements so far), but then the third candle closed displaying sellers, but buyers present. However, it's all moot because of this range lol.

|

|

|

|

|

|

#3103 |

|

Member

|

Nothing for me today. All sideways movement and times it rejected ATR and 6100 it didn't line up with trend or volume. Some instances volume and trend were opposite each other was well, so no entry.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#3104 |

|

Member

Join Date: Jul 2011

Posts: 1,759

|

Lol, what a wild end of the day.

|

|

|

|

|

|

#3105 |

|

Member

|

Same thing today. Just watching

Yesterday got movement at the end of that day based off the oil comments. See what today does. Next big catalysts is FOMC

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

#3106 |

|

Member

Join Date: Jul 2011

Posts: 1,759

|

PMI and consumer sentiment @ 9:45 and 10:00

Key level 6100, top 6150 (resistance 6140/6145), bottom 5950 (support 6085/6090) SPY watching 605.40 area for a potential bounce as well Separately, AAPL looks interesting around a 224.50 bounce area to me on the daily (not used to trading individuals much though). However, the 8 is above the 5 on the daily and weekly. |

|

|

|

|

|

#3107 |

|

Member

Join Date: Jul 2011

Posts: 1,759

|

Tested one trade out yesterday (even though the r/r it seems is generally not there on those tight range and low volume kind of days; though, I'm sure there are special circumstances that would make it worthwhile). ATH's can also be very tricky, at least for me, but finding intraday s/r is crucial.

I went light and switched to SPY for this trade with the chop, so I could work on managing multiple contracts. Aside from this setup, I saw one other potential move from the whole psych down to the LOD support area. I also noticed SPX/SPY displayed confluence at 6102 and 608 respectively, and that NQ closed above it's 21928 ATR as well at 1:00 est (or 12:00 cst) for confluence too I believe - but with that strong selling pressure - it would have been a no-go to consider testing calls. Still, it was something that stood out to me and it was interesting to observe in real time how the market reacted. What/when I traded: 3 SPY 608C contracts, deep ITM @ 11:32 est (or 10:32 cst) Reason for entering trade: Trend green at the time of entering at previous close, SPX/SPY confluence, closed above VWAP, and buyers displaying on current SPY candle (though buying volume was slowing down on the previous two candles). Exit plan/where I sold: Tight range so I had a tighter stop out, which would have been a break below 6115 or a trim at a 10 pt SPX move (retest of 6128 HOD area), ideally. I ended up trimming 2 contracts at a 6123 intraday s/r area though when the 11:30 est (or 10:30 cst) 15 min SPY candle closed with lower buyers once again. Afterwards, I moved my stop on the last contract to break even, which is where I sold after we had closed below 6123 intraday area again and the 11:45 est (or 10:45 cst) SPY candle showed sellers stepping in as well. Total gain for the trade $33. |

|

|

|

|

|

#3108 |

|

Member

|

I'll be back at it Tuesday/Wednesday. Monday I will be busy.

Seems to have not been much movement last week. Not as confident in those 3/31 Puts I have, seems like the market just is going to keep on going up with no real significant pull back. Still have some time though so we'll see.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#3109 |

|

Member

Join Date: Jul 2011

Posts: 1,759

|

Huge selloff with Deepseek news sending NVDA and others tumbling - approximately 2.0% down - to start an already loaded week with FOMC and earnings ahead. Blazed, I'm not sure here, as today seems reminiscent of early August to me, but would that expand the tradeable range today? I think last time we had huge air gaps on both sides though.

Premarket plan for today and reasoning: 1. Sizing down (Protecting capital here. Also, premiums will likely be more expensive, which isn't a bad thing, but I believe last time there was a significant move overnight/premarket there were issues with TOS too, so I don't want to find myself having trouble exiting a trade at a full position with expensive premiums. 2. Don't fight the trend (I suspect a lot of people will either be panic selling or looking to scoop up stocks perceived to be at a potential discount early, so at least for SPX/SPY I'll be waiting to see how the market settles. I'd rather miss a move than take one that doesn't line up with my strategy, and while it's fun to see such big moves overnight, it's important to temper that enthusiasm and stick to the game plan. |

|

|

|

|

|

#3110 |

|

Member

|

Deepseek just popped the tech bubble lol

Just in time for earnings

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

#3111 |

|

Member

Join Date: Jul 2011

Posts: 1,759

|

Main watch areas are support and whole psych

Also watching SPX 6035 and just keeping an eye on what we do at SPY 595/595.50 (area I had marked already, but seems like we may open around there as of now). Support areas are 5960 w/ a break below 5950 the next support being 5940. Gap @ 6088.74 |

|

|

|

|

|

#3112 |

|

Member

|

Watching 6000 here to see if it rejects or breaks above and holds. No trades, just watching

What I'm watching for the next few weeks on the downside, the next possible supports below 5900 > 5850 / 5800 FOMC on Wednesday, major tech earnings, and EOM flows on Friday. Should be a great week

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

#3113 |

|

Member

|

TSLA filled the gap, news in 1 min

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

#3114 |

|

Member

|

SPY rejected premarket high SPX rejecting 6000 so far

No trades Just watching

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

#3115 | |

|

Member

|

Quote:

Right now it looks like 6000 is a wall Need to break SPY 598.8 (PMH) and hold to even look at calls After the market digests this move/news, then look at the tradeable range and see if it needs to expand Great plan #1 & 2, no FOMO or rushing into things

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

|

#3116 | ||

|

Member

|

Quote:

It might work out but not taking it as there's no momentum yet and don't care if I miss the move NVDA needs to test daily 200, check charts (might not be today but that would be a good bounce trade as APPL hit daily 200 and bounced) but I would like to see NVDA test 90 (or lower) again, check charts, it's doable. I'll buy my CC's back @ 90 or lower. Innovation is coming for their business model and I think a better way for NVDA is to do volume business like AWS does. That said, this deepseek story is far from over, what NVDA produces is at its core is still a commodity and commodity business tends to go through the ups and downs Watching OKLO, read up on them, should test daily 50 again around 23/24 area and I'll grab some longer term equity - no options LOL Quote:

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

||

|

|

|

|

|

#3117 |

|

Member

Join Date: Jul 2011

Posts: 1,759

|

Blazed, just trying to get a better understanding, but what would you have liked to see in regard to momentum for taking calls @ PMH? That is one that definitely could have tripped me up, because it seemed like there were a lot of confirmations and a pretty nice setup. Since I'm still new to the game, I saw trend green, volume coming in stronger on the SPY 10:15 est (9:15 cst) candle than the previous red SPY bar w/ a nice VWAP bounce, and then a retest of PMH and closing above that area, but lowering volume. Though, it appeared the 9:30-9:40 your time 5 min SPX candles didn't move much, maybe creating either a nice support area for a move up/reject area for a move down? Thanks!

|

|

|

|

|

|

#3118 | |

|

Member

|

Quote:

More momentum 2mil+ on volume could have pushed past the reject area Also, flow for SPX was sideways on that push up. Wanted to see buying APPL is the only one pushing, wanted to see META/NVDA/MSFT start pushing too. Didn't see it So the r/r wasn't there for me to test yet

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

|

#3119 | |

|

Member

|

Quote:

NVDA✅- tested 200, bounced as expected then continued lower 90 or lower is the ideal area for equity add and buying CC's back  Power hour - will be interesting to see if they buy it up or drop it lower. Simple stuff to see forming on the higher timeframes

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

|

#3120 |

|

Member

Join Date: Jul 2011

Posts: 1,759

|

Took 2 trades, and both light. 5960 support area worked out and bounced a little early, though I wouldn't have taken it lol.

What/when I traded: 1 SPX 6000P contract, @ 9:42 est (or 8:42 cst) 1 SPX 6005P contract @ 10:05 est (or 9:05 cst) Reason for entering trade: First trade- Break + retest of whole psych. Neutral trend going against volume, but flow was selling hard it looked like. Huge OTM order blocks and buying cheap puts, which I thought presented an edge. Second trade- Looking for a reentry. Trend neutral and following volume at the time. Exit plan/where I sold: First trade- 10 pt move down ideally or 5 point stop out. Got stopped out and sold for a 5 point loss. Second trade- Watching flow while in the trade, it looked like it was flipping and cheap calls were being bought, so I exited this trade at the touch of SPY VWAP @ the 4th SPY candle. Lost $360 on the first trade and gained $620 on the second trade. Total gain for the day $260 |

|

|

|

|

|

#3121 | |

|

Member

Join Date: Jul 2011

Posts: 1,759

|

Quote:

|

|

|

|

|

|

|

#3122 |

|

Member

Join Date: Jul 2011

Posts: 1,759

|

Not in a rush to get in today, so I might size down again if anything- thinking we could just range around w/ tomorrow being a big day. Consumer confidence @ 10:00

Gap @ 6017.17 Gap @ 6088.74 SPX 6035/6051 reject area SPY 602.50-603 reject area SPY 599.40 bounce area |

|

|

|

|

|

#3123 |

|

Member

|

Main watch is 6000 & 6050 + ATR's. Consumder confidence at 10. Gaps at 6051.51 and 6088.74.

SPY, only thing I like is 602.5 - 603 for reject. With FOMC rate decision tomorrow, first of new administration, might be best to wait and see what market does next two days. Curious to see if Trumps "talk" with Powell results in any surprises, I would think not, but who knows.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#3124 |

|

Member

|

Only watching 6000 & 6050

6000 is a wall so it's support until it's not Downward momentum is still in play Today could be tricky so not rushing into anything

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

#3125 | |

|

Member

|

Quote:

Entered calls @ 6000, broke below 6000 and next support was ATR @ 5995. Let the trade play out, plan was a close below ATR I'll cut. Held ATR and reclaimed 6000. Full exit @ 6050 Gains from this trade $9.1k  Calling it a day here, FOMC is tomorrow. Probably won't trade until FOMC unless premarket gets a good move

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

| Bookmarks |

|

|