Quote:

Originally Posted by blazed

a lot of strong buy signals so consolidation and a move up might be in play before we start seeing some downside. Anything can change so no bias.

Spx: 4150 top / 4050 bottom (4065 resistance) / 4100 key level (4060 resistance) - spx also has a gap @ 4030 from last thursday.

Watching:

Spy bounce 406.7 and 406 (higher probability)

spy reject 414-415 area

spy needs to break 410 for more upside. Will watch around 409.5-410 for a reject in the mean time.

Also watching usoil and oil stocks based off the oil news over the weekend.

|

Quote:

Originally Posted by blazed

411.5 on spy is the next big level it needs to break above.

|

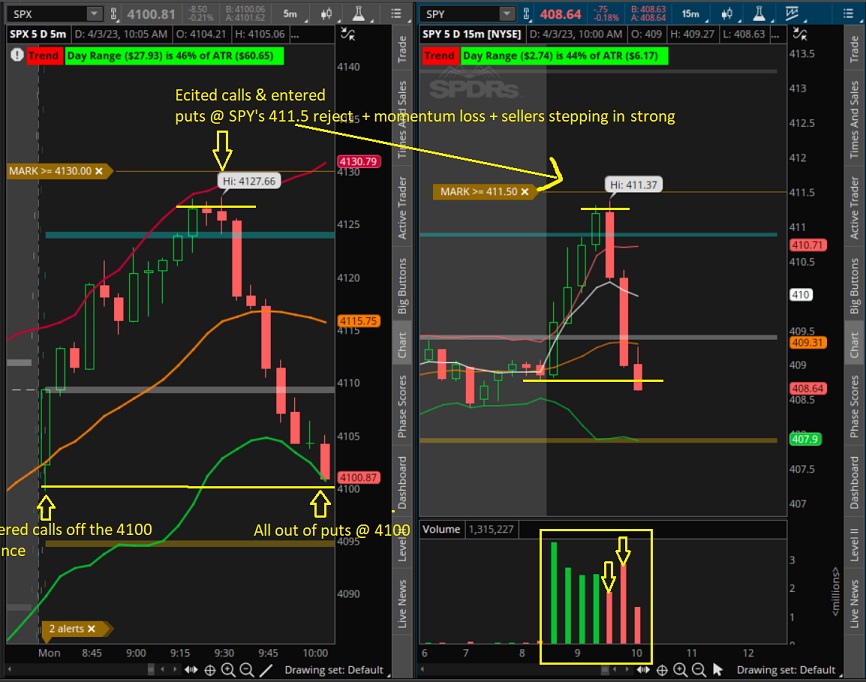

Trade recap:

I like the days where things move quick. Calling it a day here, the premarket plan played out - we got the move up then the nice sell off after as expected. Hope everyone enjoys the rest of their day.

a lot of strong buy signals so consolidation and a move up might be in play before we start seeing some downside✅- played out perfectly.

Spx: 4100 key level✅- bounced it almost to a T.

411.5 on spy is the next big level it needs to break above.✅- (4130 SPX) rejected this area, couldn't break it.

Where did I get this level? Daily chart - 411.5 played support/resistance the first half of Feb. SPY needs to break that level before we see any moves higher.

Education:

Education:

Took calls off the open @ the 4100 bounce - market looked strong and it was key level support. Watched how we did @ SPY's 410 area (volume confirmed we had more upside), then watched how we did @ the 411.5 area. We were losing momentum heading into 411.5 and sellers started stepping in. After the 3rd reject of that area on SPX (2nd reject on SPY) I cut calls and entered puts with volume confirming downside.

The market is pretty easy to read. These moves are all based off of technicals so when you see a reject area + momentum loss + sellers stepping in - cut calls and switch to puts or cut calls and wait for confirmation for puts.